georgemiller

Publish Date: Tue, 20 Jan 2026, 12:01 PM

Key takeaways

- An investment rebound is around the corner, supported by the new wave of government funding and projects.

- “DeepSeek moments” likely to emerge in other sectors, thanks to China’s continued focus on innovation.

- Reflation and housing market expectations, on the other hand, depend on policy intensity and implementation.

China data review (December, Q4 & full year 2025)

- China’s GDP grew 5.0% in 2025, meeting the government’s target of “around 5%”. However, GDP growth ended the year softer, rising 4.5% y-o-y in Q4, affected, in part, by a high base. The underlying data showed pressures have grown on the domestic economy with investment spending falling 3.8% for 2025 while ongoing resilience in trade helped keep industry production buoyant.

- Fixed asset investment (FAI) contracted by 3.8% in 2025, marking the sharpest decline in decades. The weakness remained broad-based, with significant falls in December across property (-36% y-o-y), manufacturing (-11%) and infrastructure (-10%). Insufficient “seed capital” likely hit infrastructure, while tariff uncertainties and weak business confidence weighed on manufacturing.

- Retail sales grew by 3.7% in 2025, slightly above the 3.5% recorded in 2024. However, growth softened to 0.9% y-o-y in December, due in part to a high base from trade-in subsidies in certain products. The breakdown for December shows positive impact of these consumer goods trade-in subsidies, with communications equipment sales rising by 21% y-o-y.

- Exports closed the year on a strong note, rising by 6.6% y-o-y in December. The trend of trade restructuring continued as exports to the US fell faster, while those to other markets like EU and ASEAN sustained double digit growth. Meanwhile, imports grew 5.7% y-o-y in December supported mostly by hightech products (+13.5%) and infrastructure-linked commodities, e.g., copper.

- CPI was up 0.8% y-o-y in December amidst stable core CPI (+1.2% y-o-y) and rising food prices (+1.1%), particular for vegetables (+18.2% y-o-y). On the producer front, PPI recorded a narrower y-o-y decline of 1.9% supported by rising prices of non-ferrous metals manufacturing (+10.8% y-o-y), especially copper, which hit a new record high in December.

Five key China macro themes for 2026

China’s 15th Five-Year Plan launches this year, setting the strategic direction for the country through to 2030. The main framework was shared after the Fourth Plenum on 23 October 2025, with further details expected at the annual policy meetings in March. We detail our top five macro themes to watch out for in the year of the horse.

1. We expect a rebound in fixed asset investment

Entering 2026, new government funding and project approvals should boost infrastructure and manufacturing investment. Faster government payments of overdue obligations will ease liquidity pressures and support business confidence, while a more stable US-China trade relationship may further encourage capital expenditure.

2. Innovation to drive growth

Following China’s DeepSeek moments in Generative AI and biotech, further breakthroughs are likely. The government’s latest Five-Year Plan puts strong emphasis on modernising the industrial system and driving innovation, building on years of investment and talent development. Multinationals are also increasing investment to leverage China’s expanding role as an innovation hub.

3. From exporting goods to exporting production capacity

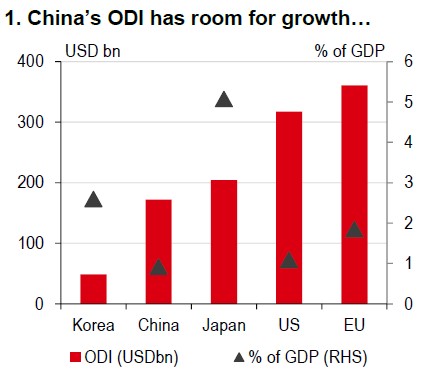

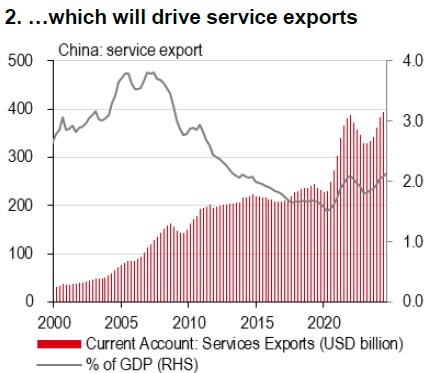

China’s exports have shown unexpected resilience, with the goods trade surplus climbing to a record high of USD1.2trn in 2025, driven by competitive pricing, strong performance, and reliability. However, Chinese manufacturers are increasingly pursuing overseas direct investment (ODI) to optimise supply chains and manage trade uncertainties. This trend is in its early stages. While outbound direct investment may partially substitute goods exports, it is likely to boost service exports.

Source: CEIC, OECD, HSBC

Source: CEIC, HSBC

4. Reflation hopes

While some remain sceptical about the impact of the anti-involution campaign, it is a key element of China’s push for a unified national market. New regulations targeting local protectionism and promoting fair competition are being introduced, and their effectiveness will influence the pace of industry consolidation.

5. Housing stabilisation

The ball is in the government’s court. Now in its fifth year, the housing correction faces renewed pressures. Recent calls for action in official channels have raised expectations of stronger intervention. One feasible approach is an asset management company model, which could safeguard financial stability, while using the acquired homes for social housing to support urbanisation.

Source: LSEG Eikon

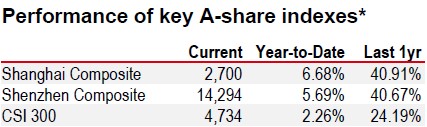

* Past performance is not an indication of future returns

Source: LSEG Eikon. As of 19 Jan 2026, market close

https://www.hsbc.com.my/wealth/insights/market-outlook/china-in-focus/five-key-china-macro-themes-for-2026/