georgemiller

Publish Date: Mon, 26 Jan 2026, 08:04 AM

Key takeaways

- The JPY has stayed weak amid domestic political uncertainty.

- “Risk-on” G10 currencies have outperformed, supported by global risk appetite and easing trade tensions.

- Domestic drivers are supporting AUD and NZD strength.

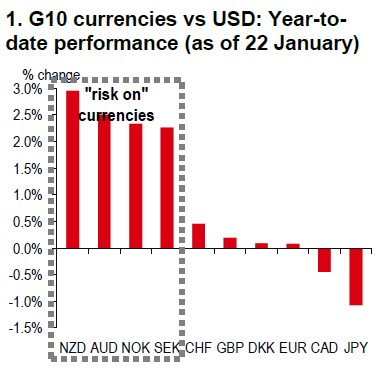

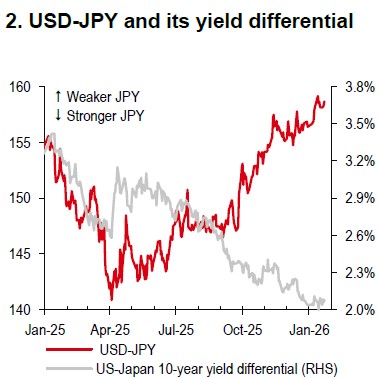

The JPY has kicked off 2026 on a weak note (Chart 1), with attention on the snap election set for 8 February (Bloomberg, 19 January). Political uncertainty in Japan has pushed USD-JPY away from the usual yield differential trends (Chart 2), signalling a growing risk premium for the JPY. With market nerves unlikely to settle over the near term, JPY weakness looks set to persist. However, Japan’s Ministry of Finance may intervene if USD-JPY rises further.

Source: Bloomberg, HSBC

Source: Bloomberg, HSBC

Meanwhile, “risk-on” currencies − AUD, NZD, NOK, and SEK – have outperformed other G10 currencies year-to-date, each posting notable gains against the USD (see Chart 1). Their outperformance appears to be somewhat supported by a favourable global risk environment, with international equities (excluding the US) outperforming the S&P 500 Index (Bloomberg, 22 January). Additionally, market sentiment might have improved following the recent easing of tensions surrounding US-EU trade issues related to Greenland.

Recent developments have highlighted the potential for rapid shifts in US policy, with periods of escalation followed by sudden reversals. This volatility has weighed on the USD, as well as US equities and bonds − a combination referred to as the “Triple Threat”. These developments warrant close monitoring (see “FX Viewpoint Flash” USD: The “Triple Threat” reminder, 21 January for further details).

On the domestic front, several factors are supporting the AUD and NZD. Our economists expect both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) to deliver two rate hikes in 2026, with the RBA anticipated to begin tightening on 3 February. Markets currently price in a c60% chance of this move (Bloomberg, 22 January), suggesting further potential for rates-driven AUD strength. While New Zealand’s rate hikes may come later, its economic recovery is gaining momentum, aided by supportive fiscal policy ahead of the general election on 7 November (ABC news, 21 January). All this could present upside risks for the NZD over the coming months.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/g10-currencies-leaders-and-laggards/