georgemiller

Publish Date: Tue, 27 Jan 2026, 07:04 AM

Key takeaways

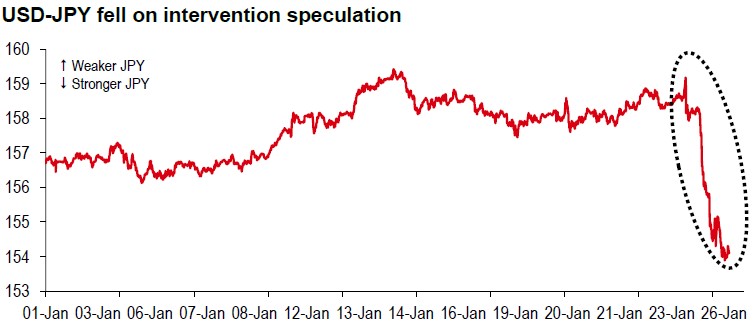

- USD-JPY fell sharply amid possible US-Japan joint FX intervention.

- History shows coordinated FX intervention can be impactful, though not a guaranteed solution.

- Japan faces fiscal consolidation challenges, with FX intervention and policy changes under consideration.

USD-JPY experienced a sharp decline late Friday during the US trading session, following reports that the New York Federal Reserve (Fed), on behalf of the US Treasury, conducted rate checks (The New York Times, 23 January). This move came after an earlier surge in USD-JPY during the Bank of Japan (BoJ) Governor Ueda’s press conference, and subsequent remarks from Finance Minister Katayama highlighting the Japanese government’s heightened vigilance over FX market developments (Bloomberg, 23 January). Given how the Japanese and US authorities have already emphasised their shared concerns about the JPY a couple of weeks ago (Bloomberg, 13 January; US Treasury’s readout on 14 January), this recent rate check suggests joint intervention is possible over the near term.

Source: Bloomberg, HSBC

Historical precedent suggests that coordinated FX intervention between Japan and the US, such as the impactful action on 17 June 1998, tends to be more effective than unilateral measures. On that occasion, both parties sold modest amounts of USD (USD0.8bn by the US and USD1.7bn by Japan), resulting in a 6% move in USD-JPY, with no further intervention for an extended period. However, frequent joint interventions over May 1989-April 1990 (where the US sold USD12bn and Japan sold USD22bn in total over numerous occasions) did not provide a lasting solution, indicating that US involvement is not necessarily a game-changer or a panacea for the JPY’s weakness.

Currently, a risk premium is evident for the JPY, as reflected by the divergence between USD-JPY and yield differentials. Market concerns regarding Japan’s fiscal sustainability have intensified amid inflation and political shifts. With general elections on 8 February and ongoing discussions around consumption tax relief, concrete strategies to address fiscal gaps remain under debate. While fiscal dominance is not inevitable, restoring credibility will require time and further action from Japanese authorities. Meanwhile, FX intervention and measures to encourage domestic investment over foreign assets may provide support for the JPY.

https://www.hsbc.com.my/wealth/insights/fx-insights/fx-viewpoint/jpy-intervention-speculation/