pctay123

Publish Date: Tue, 28 Nov 2023, 21:17 PM

- TSX ends up 4.11 points at 20,036.77

- Energy rallies 0.8%; oil settles 2.1% higher

- Bank of Nova Scotia slides on Q4 profit miss

- First Quantum falls on Panama court ruling

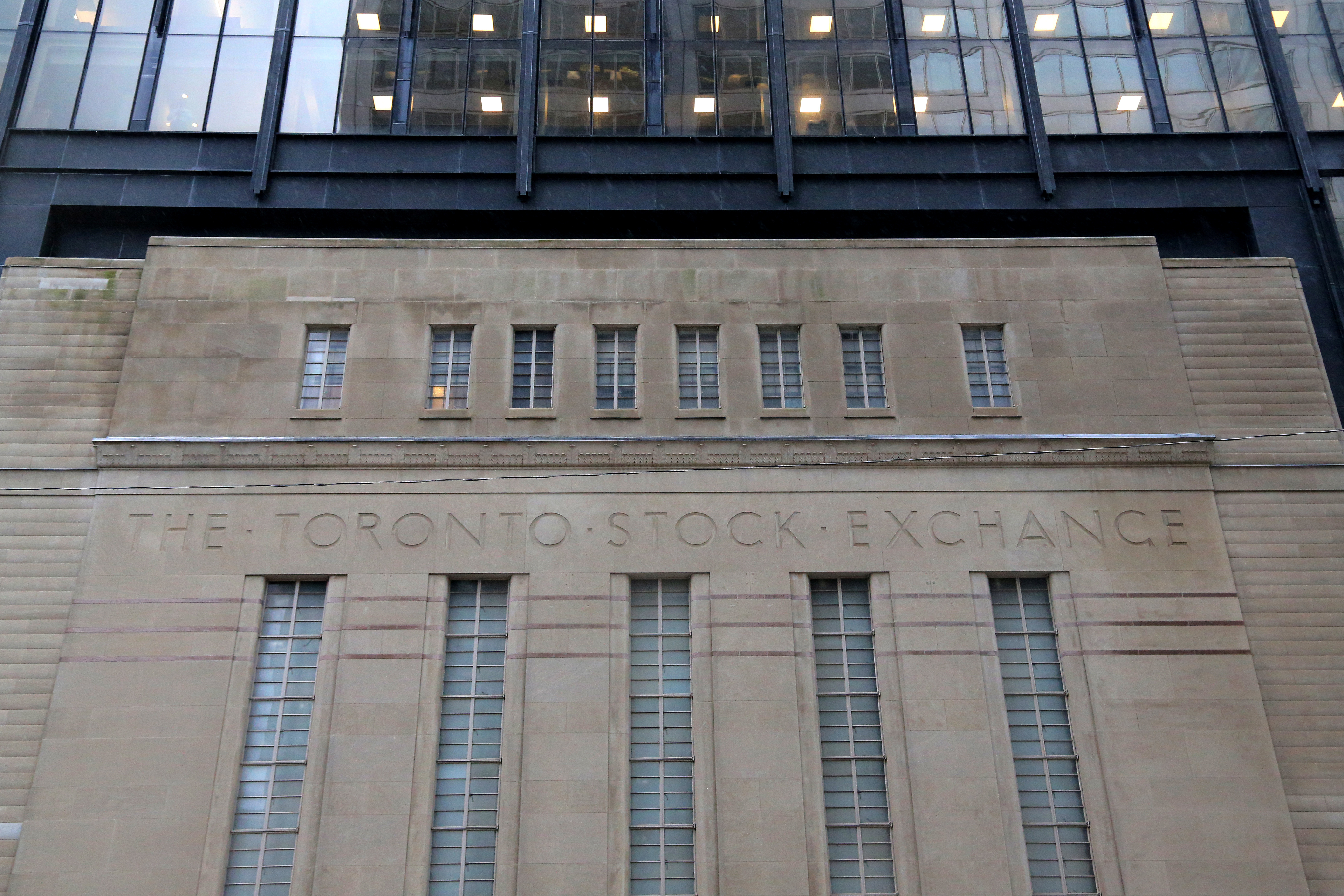

Nov 28 (Reuters) - Canada's commodity-linked main stock index ended higher on Tuesday, recouping its earlier decline, as gains for energy and gold mining shares offset weakness in financials following Bank of Nova Scotia's profit miss.

The Toronto Stock Exchange's S&P/TSX composite index (.GSPTSE) ended up 4.11 points at 20,036.77, after earlier hitting its lowest intraday level in two weeks.

The energy sector rallied 0.8% as the price of oil settled 2.1% higher at $76.41 a barrel on the possibility OPEC+ will extend or deepen supply cuts.

The materials group, which includes precious and base metals miners and fertilizer companies, added 2.5% as gold climbed to a more than six-month high, driven by a retreating U.S. dollar and expectations that the U.S. Federal Reserve has finished hiking interest rates.

Bank of Nova Scotia (BNS.TO) shares fell 4.4% after the lender missed fourth-quarter profit estimates, while the financials sector (.SPTTFS) lost 0.8%.

Shares of First Quantum Minerals Ltd (FM.TO) shed 0.8% after Panama's Supreme Court ruled the miner's contract to operate a lucrative copper mine in the Central American nation is unconstitutional.

The TSX is on track for a monthly advance of 6.2%, which would be its biggest since January, as hopes grow that global interest rates have peaked.

Canada's third-quarter gross domestic product (GDP) report and November employment numbers later this week could offer clues on the Bank of Canada's interest rate outlook.

https://www.reuters.com/markets/tsx-futures-fall-ahead-more-economic-data-bank-earnings-focus-2023-11-28/