pctay123

Publish Date: Mon, 01 Jul 2024, 07:56 AM

- Fed Chair Powell to speak on Tuesday

- Fed minutes of June policy meeting on Wednesday

- Non-farm payrolls data due on Friday

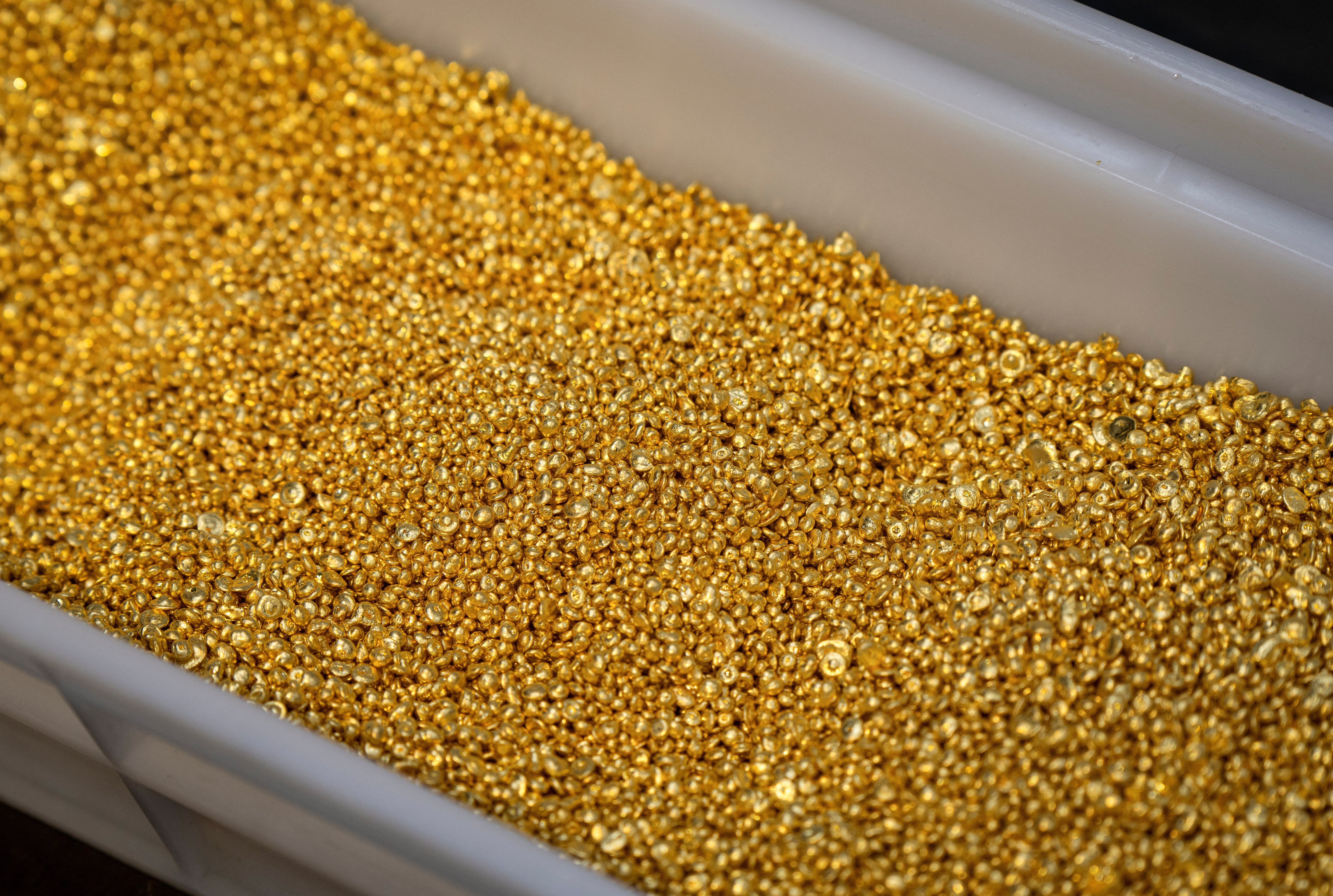

July 1 (Reuters) - Gold prices rose on Monday as the dollar softened, while investors turned cautious ahead of key economic data that could shed light on the Federal Reserve's potential rate cut trajectory.

Spot gold rose 0.4% to $2,335.40 per ounce, as of 1128 GMT. Prices registered a more than 4% gain in the second quarter. U.S. gold futures gained 0.3% to $2,345.70.

The dollar fell 0.2% against its rivals, making gold attractive for holders of other currencies.

Investor focus now shifts to remarks from Fed Chair Jerome Powell on Tuesday, followed by minutes from the Fed's latest policy meeting on Wednesday and U.S. nonfarm payrolls data due on Friday.

"Powell is likely to stick to a data-dependent stance, so should payrolls later this week come in softer, it could again lift gold prices," UBS analyst Giovanni Staunovo said, adding that gold will soar to $2,600 by the end of the year, boosted by Fed rate cuts.

Data last week showed that the U.S. prices were unchanged in May, while consumer spending rose moderately.

Market now sees a 64% chance of the Fed cutting interest rates in September as well as another cut in December.

"The upside is capped today probably also by the outcome of the French elections, supporting the euro and the French equity market," UBS' Staunovo said.

The euro jumped after a convincing and historic win by the French far right in the first round of parliamentary elections.

"Gold's bounce off the $2,300 an ounce mark last week was a bullish signal in itself ... This suggests buyers are willing to step into the market at levels below $2,300," Kinesis Money said in a note.

Spot silver was up 0.6% at $29.29, platinum fell 1.2% to $981.79 and palladium gained 1.3% to $985.20.

Sign up here.

https://www.reuters.com/markets/commodities/gold-holds-ground-slowing-inflation-boosts-fed-rate-cut-bets-2024-07-01/