2024-01-10 21:48

Is an ETF at odds with Bitcoin’s goal of breaking away from Wall Street? Absolutely. Is that same ETF also necessary for crypto to grow? Also yes. It’s the moment the crypto world has been waiting for: The Securities and Exchange Commission (SEC) has finally approved the first spot Bitcoin exchange-traded fund (ETF) in the United States. Is this mainstream-friendly investment vehicle at odds with Bitcoin’s original goal of breaking away from Wall Street? Absolutely. Is that same ETF also necessary for crypto to grow? Also yes. The crypto industry has simply not been able to reach mainstream adoption on its own. That’s why, despite the obvious contradictions, much of the crypto community has been eagerly anticipating this ETF for years. The SEC turned down application after application, but recently the tide started to turn. We never know for sure what drives up the price of Bitcoin, but ETF euphoria has been a pretty good guess. Bitcoin rallied nearly 160% in 2023 and has gained 50% in the last six months alone, a surge widely acknowledged to be driven by ETF dreams. So let’s just take a moment to talk about the elephant in the room. Bitcoin’s pseudonymous founder Satoshi Nakamoto created the world’s first major cryptocurrency specifically to decrease reliance on financial institutions. Bitcoin’s invention followed the 2008 financial crisis and the related collapse in trust in the banking system. The very first sentence of the Bitcoin white paper abstract envisions “a purely peer to peer version of electronic cash that would allow online payments to be sent from one party to another without going through a financial institution.” In other words, Bitcoin was designed to be everything an ETF is not. An ETF gives investors exposure to bitcoin in their traditional brokerage accounts via the stock market. The institutions applying for ETFs include Blackrock, Grayscale and Fidelity, the very “intermediaries” that Satoshi Nakamoto wanted to eliminate. Then there’s that favorite phrase of crypto purists, “not your keys, not your coins.” This basically means that if you are holding bitcoin on a crypto exchange as opposed to in your own wallet, for example, then that bitcoin is not truly yours. ETFs introduce yet another degree of separation. Investors in an ETF aren’t even buying actual bitcoin, they are just buying price exposure to that bitcoin. And finally, there was Nakamoto’s warning that “the cost of mediation increases transaction costs.” A Bitcoin ETF certainly doesn’t solve this problem. Instead, it comes with management fees, with Grayscale’s fees reaching up to 1.5%, even if competition is already driving some issuers' fees down. So why is the crypto world so excited about this Diet Coke version of digital currency? This is pretty far from the decentralized future that we’ve all been supposedly fighting for. The mostly simple answer, of course, is price. With some exceptions, much of the industry still remains highly vulnerable to the whims of token prices. When the markets are down, venture capitalists lose interest and sponsorships and advertising budgets suffer. Consumer-facing services find it harder to onboard new users. Furthermore, various altcoins tend to rise or sink with bitcoin. This time, bitcoin’s rise seems to be largely thanks to major financial institutions and the SEC. But the industry is not complaining about it too much. Then there is the whole mainstream adoption argument – namely that spot ETF approvals will unleash a flood of new investors who can’t be bothered to open an account at a crypto exchange, much less set up a wallet on their phone or run a node on their home computer. On a more basic level, involvement by brand-name institutions in the market may assuage investors who associate crypto with fraud. Thanks to ETFs, the crypto community has enjoyed a few weeks of relatively positive media attention, a nice break from all the Sam Bankman-Fried headlines of 2023. What the ETF really brings is more credibility. In this case, Wall Street involvement is contingent on government approval. The SEC finally approving an ETF after years of rejections based on fears of “market manipulation” indicates a degree of acceptance, however begrudging, of this asset class by one of its fiercest critics, SEC chair Gary Gensler. In theory, crypto is also independent of governments, and so the SEC shouldn’t matter that much. In reality, crypto Twitter is basically obsessed with most everything Gensler says and does. That said, Gensler’s apparent antipathy to the industry, which manifests itself in a lack of regulatory clarity and a slew of lawsuits against major industry players, has not killed the industry. Nor has it stopped crypto from booming in other parts of the world, particularly in Asia. But it has come at a cost. Some crypto companies spend years embroiled in SEC lawsuits. Others choose to avoid the U.S. entirely, despite it being the world's largest economy and a major source of capital and talent. Crypto needs some degree of government approval. It needs Wall Street involvement. The future of crypto does not look like the Wild West, it looks more like Japan, Hong Kong and Singapore, three jurisdictions with some of the toughest regulations in the world. It’s hard enough to build a decentralized project, let alone in a bear market with hostile regulators, cautious investors and wary consumers. Hopefully Wall Street’s culture will not define the industry, but will provide a stamp of credibility that allows more crypto projects to thrive. https://www.coindesk.com/consensus-magazine/2024/01/10/etf-euphoria-shows-bitcoin-needs-wall-street-after-all/

2024-01-10 21:46

Ophelia Snyder says it is impossible to conceptualize the changes in bitcoin trading volumes likely through ETF inflows. While ETF listings could occur within days of approval, the wider effect will take months to assess, said Ophelia Snyder, co-founder of crypto custodian 21Shares. It takes at least 90 days for money managers to process additions to their list of approved allocations. Even with ETFs getting the green light, the underlying asset remains at the risk of SEC disapproval. With the first spot bitcoin exchange-traded funds (ETFs) finally approved in the U.S., listings on exchanges could occur within days, said Ophelia Snyder, co-founder of crypto custodian 21Shares. Gauging their effect on the market is likely to take months. Wealth-management firms must adhere to various processes before they can add the ETFs to their list of approved allocations, said Snyder, whose Zug, Switzerland-based firm teamed up with Cathie Wood's ARK Invest to propose an ETF that was among those winning approval from the Securities and Exchange Commission (SEC) on Wednesday. "That typically takes 90 days, so we're not even going to begin to see what this actually looks like for at least a quarter," Snyder said in an interview. "Just because a product's available to trade on does not actually mean that every adviser in America can buy it ... it requires a lot of compliance for them to add the tickers – they don't get added by default." For full coverage of bitcoin ETFs, click here. Snyder said she expects the first funds to list on exchanges within two days, the same as it took the ProShares Bitcoin Strategy (BITO) ETF after its approval in October 2021. "Standard ETF process is usually a week or two. BITO was particularly fast, and I think this will be fast," she said. Snyder says it's impossible to conceptualize the potential changes in trading volumes that could result from ETF inflows. Bitcoin (BTC), the largest cryptocurrency, has rallied 50% in the past six months in anticipation of approval, with traders betting the introduction of ETFs would draw huge demand from institutional investors. Analysts at Standard Chartered forecast $1 billion of inflows in the three months after approval and potentially more than $100 billion by the end of the year. According to Snyder, there were some $1.2 trillion of net inflows into ETFs as a whole in the past 24 months. The total market cap for all cryptocurrencies is around $1.8 trillion. "That's not capital appreciation of the share base – that's net inflows," she said. "These numbers just do not coexist in the crypto space. They look very different when we play with, for lack of a better description, the big boys." Lingering uncertainties Snyder says there are other uncertainties about the crypto industry that will now be exposed to greater scrutiny: Approval does not offset the SEC's doubts about cryptocurrency in general. "What the SEC is going to do about bitcoin still matters, and that's something that people just don't totally get," she said. "Managers at financial firms are staking their reputations and their careers on the investments that they make. If they make a bitcoin investment and then the SEC decides it's illegal, that's going to be a problem." SEC Chair Gary Gensler has on several occasions indicated concerns about the crypto industry, noting the number of frauds and bankruptcies and, at one point, referring to parts of it as the "Wild West." Standing Out With the approval, providers are attempting to differentiate themselves from their peers. That's particularly the case for fees. Initial charges mainly ranged between 0.24% of net assets and 0.90%, and the first announcement sparked a race toward the low end, with a slew of reductions on Tuesday and again on Wednesday. The standout is Grayscale, which is turning its Bitcoin Trust (GBTC) into an ETF and plans to charge 1.5%. The investment firm may be relying on its size advantages over the others, offsetting the higher fee. Grayscale already has more than $27 billion of assets under management even before approval, thus being able to offer greater volume and liquidity than its competitors, who are essentially starting at zero. "I don't think they're going to see a lot of inflows with the way they're priced, but presumably their pricing strategy would suggest that's not what they're chasing," Snyder said, adding that Grayscale may be relying on largely retaining GBTC's existing investor pool. Whether Grayscale sees significant outflows to cheaper funds may depend on their investors' motivations: whether they bought their shares for the long-term, whether they're now holding them at a gain or a loss, and so on. "I don't think there's going to be immediate massive outflows, but I think that's the kind of thing you might see over time," Snyder said. "Like everything, it's going to be a process and it'll take time to see how these things shake out." Read More: Bitcoin ETFs Could See Up to $100B in Inflows If SEC Approves: Standard Chartered https://www.coindesk.com/business/2024/01/10/bitcoin-etf-listings-will-be-quick-but-money-flows-could-take-months-21shares-co-founder/

2024-01-10 21:44

Gold ETFs revolutionized the gold market and spurred a giant rally. Can bitcoin ETFs do the same? Hopes are extremely high for bitcoin ETFs, which just won SEC approval, and their ability to transform cryptocurrency investing. Gold ETFs transformed the gold market two decade ago, sparking a huge rally in gold's price – and some experts think bitcoin ETFs could do the same thing. Standard Chartered sees bitcoin's price doubling to $100,000 this year. Bitcoin ETFs, which just won regulatory approval in the U.S. on Wednesday, have been hugely hyped by dreamers exhilarated by the prospect they will open up cryptocurrency investing to the masses. But there's always the danger that the newest new thing in finance will turn into a dud. Take meme stocks like GameStop, AMC and Hertz, which won a feverish following during the pandemic that shot their prices to the moon. But it was a fad that passed. For full coverage of bitcoin ETFs, click here. Sometimes they get traction, though. Two decades ago, the debut of exchange-traded funds that let investors easily invest in gold prompted wildly optimistic predictions. "This one is going to go gangbusters," Jim Wiandt, a well-known figure in the ETF space, told MarketWatch in November 2004 when speaking about gold ETFs. "It opens up a new asset class to investors." He was right. Over $100 billion is now stashed in gold ETFs that trade in the U.S., the world's largest capital market. They have made investing in the precious metal as simple as clicking the "buy" button in a plain vanilla brokerage account; no vaults or armed guards needed. Gold soared after gold ETFs were introduced two decades ago. Standard Chartered, the global bank, views this as relevant history for bitcoin ETFs. Gold's price more than quadrupled in the seven years following their 2004 introduction in the U.S. "We expect bitcoin to enjoy price gains of a similar magnitude as a result of U.S. spot ETF approval, but we see these gains materialising over a shorter (one- to two-year) period, given our view that the BTC ETF market will develop more quickly." The firm sees the price of bitcoin rising to $100,000 by the end of this year. This is what has some crypto observers so enthusiastic about bitcoin ETFs. A flood of companies, including asset management giant BlackRock, just got approval to offer them in the U.S. There's hopes that'll bring a gusher of institutional and retail money into the investment ecosystem. "The first gold ETF undoubtedly changed the industry as it allowed gold to be included in an investment portfolio for the first time," said William Rhind, founder and CEO of GraniteShares, an independent ETF company. He's not sure bitcoin ETFs will quite match the goldenness of its predecessor, though. "I think, ultimately, there will be less demand for a spot bitcoin ETF than there was for gold because bitcoin was always digital and buying it was not a market access issue in the same way as it was for gold." Spot bitcoin ETFs – the fuller term for the just-approved products, which own bitcoin itself, as opposed to the bitcoin futures ETFs that have already existed for several years and which hold derivatives contracts instead – have the potential to develop into a $100 billion product, according to some analysts. That, in turn, could result in a significant shift for the cryptocurrency industry. Giving investors more options Without bitcoin ETFs, institutional investors have few options for investing in the world's largest cryptocurrency. Most do not have the infrastructure to hold bitcoin directly nor have authorization to trade it at existing exchanges, so they can either invest through futures ETFs like ProShares' BITO or closed-ended funds such as Grayscale's Bitcoin Trust (GBTC). However, these options come with high fees and multiple downsides. Similar to how the first gold ETF created in 2003 injected billions of dollars worth of inflow into gold, a bitcoin spot ETF could potentially do the same. Bernstein, the brokerage, said in a research report it expects a spot bitcoin ETF market to be sizable, reaching 10% of bitcoin's market capitalization in two to three years. (Bitcoin's market cap is around $900 billion.) Martin Leinweber, a digital asset product strategist at MarketVector Index, said the current exchange balances of bitcoin equate to around $47.5 billion, so an ETF approval could bring more than triple the amount of capital to bitcoin than what every single exchange currently holds. The first gold ETF increased demand for gold, and a bitcoin spot ETF might do the same. Since the first gold ETF was launched in 2003, gold prices have jumped from around $332 to $1,800, and there are around 35 gold ETFs traded on the U.S. markets. Gold ETFs have a total of $105 billion assets under management (AUM). Bitcoin soared 155% in 2023. Much of the gain followed BlackRock's surprising June filing for a bitcoin ETF. Bitcoin went from trading at a low of around $25,500 on June 15 to about $46,000 now. Rhind explained that the major market for gold ETFs was from professional investors like financial advisers or asset managers who now could own gold for the first time in their portfolios. As such, there was a huge amount of pent-up demand for this, which was reflected in AUM rising exponentially in fairly short order. Leinweber said that approval for a bitcoin spot ETF by a traditional institution would be a significant validation for the cryptocurrency space. "As the U.S. is currently lagging behind other countries in terms of spot bitcoin ETFs, this move could position Wall Street as a more dominant player in the global crypto space," Leinweber said. Currently, bitcoin ETFs exist in Canada and Europe. However, data from Euronext shows that the Jacobi ETF in Europe has seen muted trading volume since launching in August. There is potential for the likes of BlackRock to advise their clients to allocate a proportion of their portfolio to the bitcoin ETF that they offer. "If financial advisers and institutions find a bitcoin ETF as liquid and convenient as other popular ETFs (like GLD or SPY), they might very well allocate around 1% or more to it," said Leinweber. "It is not outlandish to imagine a scenario where traditional finance firms are going so far as to recommend small allocations to crypto via ETFs," according to Conor Ryder, head of research at Ethena Labs. "From an overall portfolio allocation perspective, a small allocation to a highly volatile asset with asymmetric upside makes a lot of sense, and now they can point them towards their own ETFs for some fees." Bitcoin ETFs showcase the merging of the traditionally separate worlds of crypto and traditional finance. Mona El Isa, CEO of Avantgarde, recognizes the significant potential impact of a bitcoin spot ETF approval, stating, "The approval of a bitcoin spot ETF holds immense significance for the cryptocurrency industry. It has the potential to bring substantial capital into the market, potentially in the billions, as investors seek exposure to bitcoin through a trusted and regulated vehicle." Given that bitcoin ETFs directly hold the underlying asset, there could also be organic demand for bitcoin itself, said El Isa. "This could potentially drive up its value as more investors, including institutional allocators like BlackRock and Fidelity, seek to hold the asset within the ETF. This, in turn, could have a cascading effect, further solidifying bitcoin's position in the global financial landscape." In terms of the balance of power, El Isa adds, bitcoin ETF approval signifies "a growing acknowledgment of cryptocurrencies within traditional finance. It can lead to increased collaboration between crypto and Wall Street, ultimately reshaping the dynamics of the industry as we know it." Before bitcoin ETFs, the next best option was the Grayscale Bitcoin Trust (GBTC). It has almost $30 billion of assets under management. GBTC's popularity among investors – despite being harder to buy than an ETF and having a less-appealing structure – suggests that there could be a significant amount of appetite for a spot bitcoin ETF. "There will no doubt be demand for a spot bitcoin ETF, the question is really more about appetite from investors or enthusiasm for bitcoin after all the recent travails in the crypto space," said Rhind. https://www.coindesk.com/markets/2024/01/10/why-is-a-bitcoin-etf-a-big-deal-the-gold-revolution-helps-explain/

2024-01-10 21:33

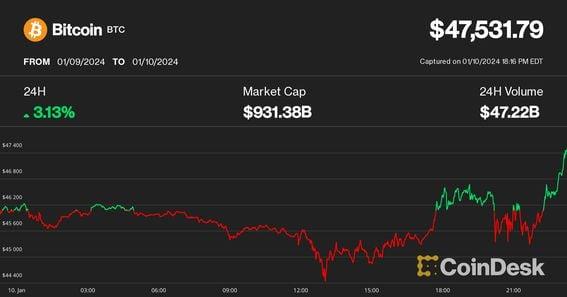

Now, attention turns to how much demand these investment vehicles will attract. Bitcoin wobbled then rose past $47,000 following regulatory approval of spot bitcoin ETFs. Ether jumped 11% to a 20-month high as ETF speculation turns to the second-largest asset. The wider impact of the ETFs will take months to see, 21Shares co-founder Ophelia Snyder said in an interview. Bitcoin (BTC) and other cryptocurrencies surged on Wednesday after U.S. regulators approved bitcoin ETFs, a landmark decision for the digital asset industry that could dramatically broaden the investor base for bitcoin. For full coverage of bitcoin ETFs, click here. Bitcoin recently traded around $47,500, up from just below $46,000 before the news broke Wednesday afternoon. Ethereum's ether (ETH), the second-largest crypto by market capitalization, jumped 11% and exceeded $2,500 for the first time in 20 months as attention turns to U.S. applications for ether ETFs. Michael Silberberg, head of investor relations at crypto hedge fund Alt Tab Capital, said to expect "frothy price accumulation as capital will flow into the market from a new class of institutional buyers to crypto." Shares of the Grayscale Bitcoin Trust (GBTC), the largest closed-end bitcoin fund that now has permission to convert into an ETF, popped to $40, their highest price since December 2021, TradingView data shows. The stock price of Coinbase (COIN), the digital asset exchange whose custody service plays a key role for most bitcoin ETF issuers, was flat around $151. Bitcoin miners Marathon Digital (MARA) and Riot Platforms (RIOT) also remained unchanged. Anticipation of the first bitcoin ETFs in the U.S. that can hold bitcoin, instead of just derivatives, has been a boon to the crypto market since Wall Street giant BlackRock filed paperwork in June to create one – a move soon followed by other applicants. These vehicles are considered superior to already listed futures-based offerings, with bulls betting they will attract significant inflows to the largest cryptocurrency. What's next for crypto prices Despite 10 years of failed attempts to list spot bitcoin ETFs in the U.S., most market observers overwhelmingly expected regulatory approval this time, given BlackRock's track record of successful applications and asset manager Grayscale's court victory over the agency in August. Now, attention turns to how much demand these investment vehicles will attract when they start trading. While the ETFs may trade as soon as Thursday, the wider impact of the products will be seen in months, Ophelia Snyder, co-founder of crypto investment product issuer 21Shares, said in a CoinDesk interview. Bartosz Lipiński, CEO at crypto trading platform Cube.Exchange, pointed out that ether outperformed bitcoin amid the news, suggesting that altcoins will also benefit. "It's been a while since the second-largest digital asset moved 10% in a single day, so this is rather substantial," Lipiński said in an emailed note. "Looking forward, it would make sense to see BTC eventually resume rallying higher as supply becomes more scarce while these 11 ETFs begin to gobble up significant amounts of supply," he explained. "With bitcoin potentially becoming harder to buy, it would also make sense that other coins begin to fill the void left behind." "ETH, solana (SOL), Polygon (MATIC), and others could greatly benefit from this desire to find additional opportunities elsewhere in the digital assets ecosystem," Lipiński added. https://www.coindesk.com/markets/2024/01/10/bitcoin-wobbles-below-46k-ether-and-grayscales-gbtc-jump-as-sec-approves-spot-bitcoin-etfs/

2024-01-10 21:00

The asset management industry has tried launching a spot bitcoin ETF for over a decade. Hopes are high they will lure more investors into crypto. U.S. regulators approved bitcoin ETFs, dramatically broadening access to the 15-year-old cryptocurrency. The Securities and Exchange Commission on Wednesday declared effective key filings from the markets seeking to list the groundbreaking products. They will begin trading on Thursday. Bitcoin's price topped $47,500 following the decision. Other cryptocurrencies rallied, too. For full coverage of bitcoin ETFs, click here. About a dozen companies, including BlackRock, Fidelity and Grayscale, sought to create bitcoin (BTC) ETFs. In recent days they've announced – and, in some cases, slashed – the fees they plan to charge investors, suggesting a fierce battle to win investors' money is ahead. These are spot ETFs, meaning they hold bitcoin itself, versus the already-approved bitcoin futures ETFs, which hold derivatives contracts tied to BTC. The green light from the SEC follows many years of delays and outright rejections of numerous attempts to launch spot bitcoin ETFs. It also comes just a few months after the agency was handed a resounding loss in court. The D.C. Circuit Court of Appeals in August ruled the SEC was "arbitrary and capricious" in its decision to reject Grayscale's attempt to convert its roughly $26 billion Grayscale Bitcoin Trust (GBTC) into a spot ETF. In a statement, SEC Chair Gary Gensler pointed to a court loss in 2023 as part of its impetus to approve the dozen or so filings on Wednesday. "The U.S. Court of Appeals for the District of Columbia held that the Commission failed to adequately explain its reasoning in disapproving the listing and trading of Grayscale’s proposed ETP (the Grayscale Order). The court therefore vacated the Grayscale Order and remanded the matter to the Commission. Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares," he said. Advocates for a spot bitcoin ETF have long argued that a regulated trading product focused on the world's oldest cryptocurrency would allow institutional and retail clients to gain exposure to bitcoin's price movements without requiring them to set up wallets or otherwise directly invest in the digital asset. ETF shares, for example, will be available to any U.S. investor with a brokerage account. SEC Commissioner Hester Peirce, a longtime advocate for the digital asset industry, said the logic behind the regulator's previous rejections for spot bitcoin ETF filings was "perplexing." "Although this is a time for reflection, it is also a time for celebration. I am not celebrating bitcoin or bitcoin-related products; what one regulator thinks about bitcoin is irrelevant. I am celebrating the right of American investors to express their thoughts on bitcoin by buying and selling spot bitcoin ETPs," she said. However, SEC Commissioner Caroline Crenshaw said she dissented from the approval order, saying "substantial evidence indicates" the bitcoin spot market is not safe from fraud or manipulation. Spot and futures products are not the same, she said, disagreeing with the 2023 court judgement. "Today we rely on a questionable correlation between a disaggregated, unregulated spot market and a futures market that the SEC itself does not regulate. As I noted, we rest our laurels on the idea, or hope, that whenever fraud and manipulation in that underlying spot market occurs it should hopefully become apparent in the surveillance of that futures market. I’m not convinced that such transparency will exist," she said. The SEC approval early this year became seemingly a sure thing toward the end of 2023. A flurry of meetings between the agency and the proposed ETF issuers, alongside numerous amendments to the applicants' ETF S-1 filings, gave the impression of "i's" being dotted and "t's" being crossed ahead of launch. NYSE Arca, Cboe BZX and Nasdaq filed their final 19b-4 submissions at the end of last week, bringing the filings more in line with the amended S-1 filings submitted by the would-be ETF issuers, which also include companies Galaxy/Invesco, Ark and Franklin Templeton. Earlier on Wednesday, brokerages like Fidelity and E-Trade began putting tickers tied to some of these ETFs onto their platforms. With rising optimism about spot ETFs, the price of bitcoin shot from around the $27,000 level on Oct. 1 to over $45,000 at the start of 2024. Jenn Rosenthal, vice president for communications at Grayscale, said in a statement, "I am happy to confirm that the Grayscale team has received necessary regulatory approvals to uplist GBTC to NYSE Arca, and we will share a press release with additional information shortly." Hashdex Chief Investment Officer Samir Kerbage similarly said it was "a monumental day in the history of digital assets." The SEC initially published, then seemingly deleted, an order approving the U.S.'s first spot bitcoin ETFs (exchange-traded funds) on Wednesday. https://www.coindesk.com/business/2024/01/10/bitcoin-etfs-win-sec-approval-bringing-easier-access-to-biggest-cryptocurrency/

2024-01-10 21:00

The 22-page document wasn't available for long. The U.S. Securities and Exchange Commission posted a long document approving bitcoin ETFs on Wednesday, and then it disappeared from its website within a few minutes. A 22-page PDF approving exchange 19b-4 filings went live on the SEC website shortly before 4 p.m. ET Wednesday, though the link later led to a 404 page. The SEC did not immediately respond to an email asking about the document. This is a developing story and will be updated. https://www.coindesk.com/business/2024/01/10/sec-posts-order-approving-bitcoin-etfs-and-then-it-disappears-from-website/