2025-08-07 12:04

Destruction has been massive, state chief minister says Rescuers evacuate 400 people near pilgrim spot of Gangotri Communications disrupted as power, mobile towers swept away BHATWADI, India, Aug 7 (Reuters) - Indian rescuers used helicopters on Thursday to pluck to safety people stranded by flood waters in the Himalayan state of Uttarakhand, two days after a sudden inundation and landslide killed four people, with more still missing. With roads cleared as rain eased, rescue teams arrived in Dharali, where Tuesday's wall of water had submerged in sludge homes and cars in the village on the route to the Hindu pilgrim town of Gangotri. Sign up here. Helicopters were carrying to safety those who had been stranded, the state's chief minister, Pushkar Singh Dhami, said in a post on X. Dhami said the destruction was "massive" and that the number of missing persons was still being estimated. "If the weather supports us then we will bring every single person by tomorrow," he told Reuters, referring to rescue efforts. Authorities said about 400 people stuck in Gangotri were being rescued by air, with nine army personnel and seven civilians among the missing. Relatives of missing people gathered at the helicopter base at Matli village, desperately searching for their loved ones. Mandeep Panwar said he wanted to reach Dharali, where his brother ran a hotel and is among those missing since Tuesday. "If you see the videos, ours was the first hotel to be hit by the deluge. I have not heard from my brother and he has been missing since," Panwar said. Communication links with rescuers and residents remained disrupted, as mobile telephone and electricity towers swept away by the floods have yet to be replaced, officials said. Earlier, army rescuers used their hands, as well as machinery, to shift boulders from roads turned into muddy, gushing rivers, visuals showed. More than 225 army personnel were drafted into the rescue, their Northern Command said on X. "We saw Dharali falling before our eyes," said Anamika Mehra, a pilgrim headed for Gangotri when the flooding hit. The hamlet of about 200 people in the state's Uttarkashi district stands more than 1,150 metres (3,775 feet) above sea level on the climb to the temple town. Uttarakhand is prone to floods and landslides, which some experts blame on climate change. https://www.reuters.com/business/environment/helicopters-rescue-people-stranded-by-floods-key-india-pilgrim-route-2025-08-07/

2025-08-07 11:55

Sterling up as four BoE policymakers vote to keep rates unchanged Euro drops after hitting high on hopes for peace in Ukraine Risks of partisanship in U.S. institutions weigh on dollar US jobs data in focus Aug 7 (Reuters) - The euro edged lower after hitting a fresh 1-1/2-week high earlier in the session on Thursday as investors welcomed talks in search of a breakthrough to end the war in Ukraine. The pound jumped after the Bank of England cut interest rates on Thursday but four of its nine policymakers - worried about high inflation - sought to keep borrowing costs on hold. Sign up here. Analysts said the Monetary Policy Committee remained committed to its 'gradual and careful' approach to monetary easing, easing fears for a more hawkish approach. Sterling was last up 0.55% at $1.3421. "With four dissenters, the future descent of UK interest rates remains in doubt," said Michael Metcalfe, head of macro strategy at State Street Markets. "The MPC’s doubters look unlikely to be assuaged any time soon unless fiscal policy gets notably more contractionary." The U.S. dollar was flat after falling earlier in the session, amid growing concerns over partisanship creeping into key U.S. institutions. Initial U.S. jobless claims, due later in the session, will be closely watched following last week's disappointing nonfarm payrolls report, which triggered a dovish repricing of the Federal Reserve easing path and a slide in the greenback. The euro was down 0.1% at $1.1645, after hitting $1.1688, its highest level since July 28, with a possible peace deal in Ukraine seen as a positive driver. PRESIDENTS MEETING Russian President Vladimir Putin and U.S. President Donald Trump will meet in the coming days, after Trump's envoy, Steve Witkoff, held talks with Putin in search of a breakthrough to end the Ukraine war. "Sectors to benefit (from a possible peace deal) should be European consumers, growth-sensitive and construction-related sectors," said Mohit Kumar, economist at Jefferies. "It should also be positive for Eastern Europe as most of the reconstruction efforts would likely flow through Eastern European economies." The Swiss franc dropped 0.20% to 0.8079 versus the dollar , after President Karin Keller-Sutter returned from Washington empty-handed after a trip aimed at averting a crippling 39% tariff on the country’s exports to the U.S. "While we still believe that a deal will ultimately be reached, it is likely to be far more expensive than Switzerland had hoped," said Michael Pfister, strategist at Commerzbank. U.S. President Donald Trump last week fired the official responsible for the labour data he did not like, and focus is centring on his nomination to fill a coming vacancy on the Fed's Board of Governors and candidates for the next chair of the central bank. The dollar index , which measures the greenback against a basket of major peers, was up 0.05% at 98.28 after hitting a new 1-1/2-week low at 97.94. Fed funds futures are now pricing in a 91% probability of a 25 basis point cut at the Fed's September meeting, up from 48% a week ago, according to the CME Group's FedWatch Tool. In total, traders see about 60 basis points in cuts this year. The president said on Tuesday he would decide on a nominee to replace outgoing Fed Governor Adriana Kugler by the end of the week and had separately narrowed the possible replacements for Fed Chair Jerome Powell to a short list of four. China's yuan firmed slightly, supported by a stronger official midpoint and upbeat Chinese trade data. https://www.reuters.com/world/middle-east/euro-slips-after-new-high-ukraine-talks-pound-jumps-after-boe-2025-08-07/

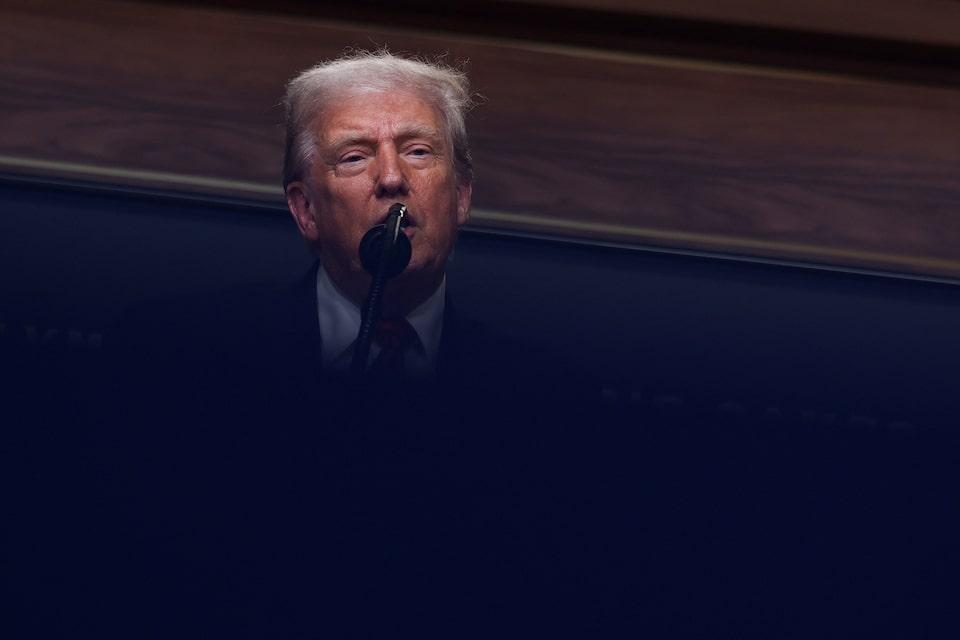

2025-08-07 11:53

WASHINGTON, Aug 7 (Reuters) - U.S. President Donald Trump is expected to sign an executive order on Thursday that aims to allow private equity, real estate, cryptocurrency and other alternative assets in 401(k) retirement accounts, a White House official said. "The order directs the Securities and Exchange Commission to facilitate access to alternative assets for participant-directed defined-contribution retirement savings plans by revising applicable regulations and guidance," the White House official said on condition of anonymity. Sign up here. The order also directs the Labor Secretary to consult with her counterparts at the Treasury Department, the SEC and other federal "regulators to determine whether parallel regulatory changes should be made at those agencies," the official said. Such a move would be a boon for big alternative asset managers such as Blackstone (BX.N) , opens new tab, KKR (KKR.N) , opens new tab and Apollo Global Management (APO.N) , opens new tab by opening the $12 trillion market for retirement funds, known as defined contribution plans, to their investments. However, critics say it could add too much risk to retirement accounts such as 401(k)s. The president is scheduled to sign executive orders at 12:00 ET, according to a White House public schedule. https://www.reuters.com/business/finance/trump-sign-order-opening-way-alternative-assets-401ks-official-says-2025-08-07/

2025-08-07 11:50

Global shares rise on earnings, Fed rate cut hopes European shares supported by Ukraine ceasefire expectations Sterling rises after "hawkish" BoE rate cut LONDON, Aug 7 (Reuters) - Global equities rose on Thursday, with Japanese shares hitting a record high, as upbeat earnings, growing hopes for a ceasefire in Ukraine and expectations for U.S. rate cuts boosted sentiment. Markets largely shook off U.S. President Donald Trump's latest tariff volleys, including an additional 25% tariff on U.S. imports from India over purchases of Russian oil and a threatened 100% duty on U.S. imports of chips. Sign up here. "It's surprising that everything that gets thrown at the market that it just continues to melt-up," said Eddie Kennedy, head of bespoke discretionary fund management at Marlborough. Europe's STOXX 600 (.STOXX) , opens new tab rose 1%, with major indexes in Frankfurt (.GDAXI) , opens new tab and Paris (.FCHI) , opens new tab up 1.7% and 1.3%, respectively. Britain's FTSE 100 (.FTSE) , opens new tab was the outlier, dropping 0.8% after the Bank of England lowered interest rates but in a split vote, with four voting to keep rates unchanged. Plans for a meeting between U.S. President Trump and Russian President Vladimir Putin over the war in Ukraine also helped sentiment in European equities and underpinned the euro. "It (a ceasefire) would be an extra positive," said Emmanuel Cau, Barclays head of European equity strategy. "If there is a de-escalation, it would clearly be supportive. It's not the key driver but it's definitely been a lingering issue for Europe." U.S. S&P 500 futures rose 0.7%. On Wednesday, the cash index (.SPX) , opens new tab climbed 0.7%. "Wall Street seems to have gotten its mojo back," Capital.com analyst Kyle Rodda wrote in a note. "However, there are persistent risks to the downside. Downside surprises in official data are increasing," he said. "Valuations are also stretched, with forward price to earnings hovering around the highest in four years. And trade uncertainty persists." In Asia, Japan's broad Topix index (.TOPX) , opens new tab rose 0.7% to a record closing high, with the more tech-focused Nikkei (.N225) , opens new tab also gaining by about the same. Taiwan's stock benchmark (.TWII) , opens new tab jumped as much as 2.6% to a more than one-year peak. Shares in chipmaker TSMC (2330.TW) , opens new tab, which this year announced additional investment in its U.S. production facilities and so is expected to be relatively unscathed by the U.S. tariff on imported chips, soared 4.9% to a record high. The KOSPI (.KS11) , opens new tab added 0.9%, with South Korea's top trade envoy saying Samsung Electronics (005930.KS) , opens new tab and SK Hynix (000660.KS) , opens new tab would not be subject to 100% tariffs. Hong Kong's Hang Seng (.HIS) , opens new tab rose 0.7%, although mainland Chinese blue chips (.CSI300) , opens new tab were only slightly higher on the day. The yuan firmed slightly to 7.1832 per dollar in offshore trading . DOLLAR STEADY, STERLING JUMPS AFTER BOE The U.S. dollar was steady against major peers after its recent fall on expectations of easier policy from the Federal Reserve, stoked both by some disappointing macroeconomic data - not least Friday's payrolls report - and Trump's move to install new picks on the Fed board that are likely to share the U.S. President's dovish views on monetary policy. Focus is centring on Trump's nomination to fill a coming vacancy on the Fed's Board of Governors and candidates for the next chair of the central bank, with current Chair Jerome Powell's tenure due to end in May. The benchmark 10-year U.S. Treasury yield was up 1.5 basis points at 4.2461%. The two-year yield , which is more sensitive to changes in interest rate expectations, was up 2 basis point at 3.7258%, but remained close to a three-month low of 3.659% touched on Monday. The dollar index , which gauges the currency against the euro, sterling and four other counterparts, eased 0.2% to 98.031, extending a 0.6% drop from Wednesday. The euro was flat at $1.1653, following the previous session's 0.7% jump. Sterling rose 0.5% to $1.3412 after a highly-divided decision by the BoE to lower interest rates. Four of the nine rate-setters on the Monetary Policy Committee, worried about inflation, voted to keep rates unchanged. "The vote split is clearly a lot more hawkish than I was expecting," said Dominic Bunning, head of G10 FX strategy at Nomura. In commodities, spot gold added 0.3% to $3,376 an ounce, after earlier hitting its highest level in two weeks. Crude oil prices snapped five days of losses although trimmed some of the earlier gains after the Kremlin said Trump and Putin were to meet. Brent crude futures were up 0.6%, at $67.29 a barrel while U.S. West Texas Intermediate crude gained 0.6% to $64.73. https://www.reuters.com/world/china/global-markets-wrapup-5-2025-08-07/

2025-08-07 11:49

Aug 7 (Reuters) - Indian jeweller and watchmaker Titan (TITN.NS) , opens new tab reported a rise in first-quarter profit on Thursday, as consumers continued to buy gold jewellery, albeit low-carat, lightweight designs due to high bullion prices. Titan, home to Tanishq and CaratLane brands, posted a profit of 10.91 billion rupees ($124.65 million) for the quarter ended June 30, compared with 7.15 billion rupees a year earlier. Sign up here. ($1 = 87.5240 Indian rupees) https://www.reuters.com/world/india/indias-titan-posts-higher-first-quarter-profit-steady-jewelry-demand-2025-08-07/

2025-08-07 11:44

Aug 7 (Reuters) - The pound rallied and UK stocks and bond prices tumbled on Thursday after the Bank of England cut interest rates as expected, although concern over inflation among its policymakers stirred up unprecedented division. Four of the BoE's nine policymakers voted to keep rates on hold, after the Monetary Policy Committee had to have two rate votes for the first time in its history. Sign up here. The BoE is being pulled in different directions as Britain's job market has weakened in recent months, but inflation is rising. The vote split suggests that more policymakers are prioritising the inflation side of that equation than investors had thought prior to the meeting, something that could cause them to pare back bets on further easing. The pound rose as much as 0.6% to a session high of $1.343, before retreating to $1.3407, up 0.4% on the day. Yields on UK government bonds, or gilts, rose, as traders reassessed how much more the BoE will cut rates this year. The benchmark 10-year yield at one point rose over 6 basis points at 4.597%, and was last at 4.58%. Rate-sensitive two-year yields were up to 3.89%. , "Essentially the committee collectively is more concerned with the pace of disinflation, and that resulted in less willingness to cut rates across members than we had believed," said Philip Shaw, chief economist at Investec. "We are still for now forecasting a 25 bps cut to rates in November, but clearly we could be looking at another very finely balanced decision and the outturn will of course depend on the data between then and now. " London's blue chip FTSE 100 index (.FTSE) , opens new tab extended an earlier loss, and was last down 0.8%, with the mid cap FTSE250 index giving back earlier gains to trade just below flat. (.FTMC) , opens new tab The broad European benchmark was up nearly 1%. (.STOXX) , opens new tab "Going forward, further disagreements should be anticipated as members' positions become increasingly entrenched, reflecting the increasing divergence of key data points," Jeremy Batstone-Carr, a strategist at Raymond James Investment Services, said, calling the rate decision "razor-edged". https://www.reuters.com/world/uk/pound-jumps-uk-bond-prices-fall-after-razor-edge-boe-vote-rates-2025-08-07/