2025-10-16 21:18

NEW YORK, Oct 16 (Reuters) - Making sense of the forces driving global marketsBy Alden Bentley, Editor in Charge, Americas Finance and MarketsJamie is enjoying some well-deserved time-off, but the Reuters markets team will still keep you up to date on what markets were focused on today and why they took a breather. I'd love to hear from you so please feel free to reach out at [email protected] , opens new tab Today's Key Reads Sign up here. Today's Key Talking Points Regionals spoil the banking party Tumbling financial stocks stole the punchbowl from the S&P's cautious recovery. Zions Bancorp disclosed a $50 million third-quarter loss on souring California loans, which was enough to sap the remaining bullishness from strong earnings reports from six of the nation's largest banks on Tuesday and Wednesday. The S&P 500 Banks index fell 3.5%, more than reversing a 1.2% gain the previous session. The KBW regional bank index (.KRX) , opens new tab fell 7%. Meanwhile, optimism about artificial intelligence was not sufficient to hold the market together. An early rally by chipmakers buoyed things after Taiwan's TSMC 2330.TW , opens new tab, the world's largest maker of advanced semiconductors, raised its full-year revenue forecast on a for AI spending. The market was fragile given the recent downward spiral in U.S.-China trade relations, even as the big banks provided hopeful signs of economic resilience, at a time when economic data, good or bad, is in short supply due to the ongoing . Greenback in the red The U.S. dollar logged its third consecutive down session against major currencies including the euro, yen and Swiss franc amid . China the U.S. of stoking panic over its rare earth controls and said Treasury Secretary Scott Bessent had made "grossly distorted" remarks about a top Chinese trade negotiator, rejecting a White House call to roll back the curbs. Dollar/yen extended its loss after U.S. midday after Seiichi Shimizu, the Bank of Japan's assistant governor, said the central bank must be careful when normalizing monetary policy due to uncertainty about how the economy would react to a new environment of positive interest rates. Fed Governor Christopher Waller said he supported an in October due to mixed readings on the state of the job market. A parade of Fed speakers this week, including Chair Jerome Powell, did not dampen conviction that the Fed policy meeting at the end of the month will end with another rate cut. The blackout period starts Saturday and the last speaker before things go quiet is St. Louis Fed President Alberto Musalem on Friday. Stars aligned for gold Gold hit a record high for the fourth straight session. The venerated safe-haven metal has gained over 60% year-to-date, driven by geopolitical tensions, aggressive rate-cut bets, central bank buying, de-dollarization and robust ETF inflows. What could move markets tomorrow? Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. Trading Day is also sent by email every weekday morning. Think your friend or colleague should know about us? Forward this newsletter to them. They can also sign up here. https://www.reuters.com/world/china/trading-day-regionals-spoil-banking-party-2025-10-16/

2025-10-16 21:10

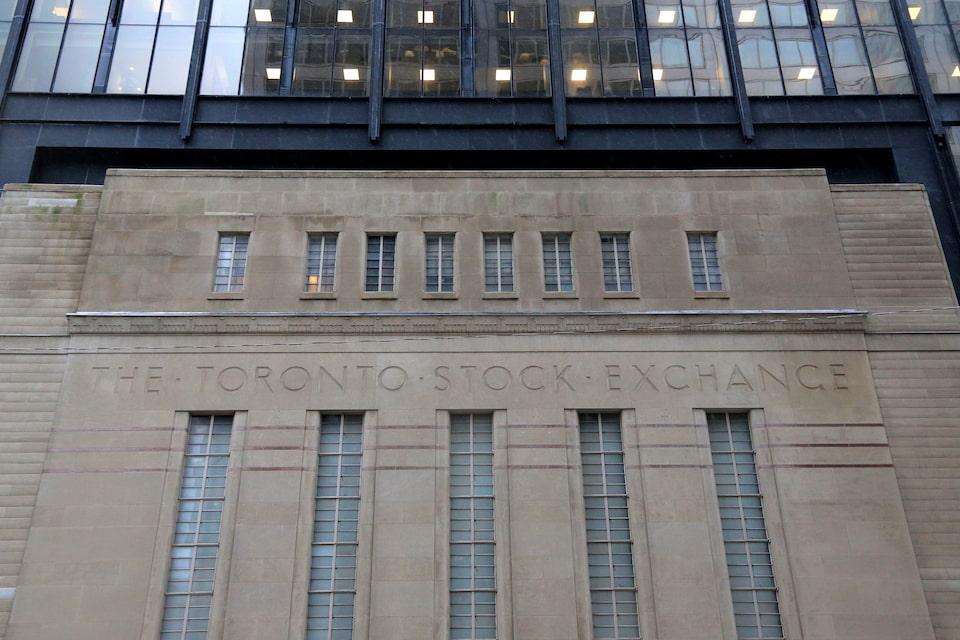

TSX ends down 0.6%, at 30,458.80 Financials decline 1.7% Energy loses 1.9% as oil settles 1.4% lower Materials group rises 1.9% as gold hits a record high TORONTO, Oct 16 (Reuters) - Canada's main stock index pulled back on Thursday from a record high as declines for financial and energy shares offset gains for metal miners. The S&P/TSX composite index (.GSPTSE) , opens new tab ended down 178.32 points, or 0.6%, at 30,458.80, after notching a record closing high on Wednesday. Since the start of the year, the index has added 23.2%. Sign up here. "The Canadian stock market is in a sweet spot with precious metals experiencing a tremendous surge and gold miners occupying a significant position within the TSX," said Matt Skipp, President of SW8 Asset Management. The materials group (.GSPTTMT) , opens new tab accounts for 17% of the TSX's market capitalization. That's the second heaviest weighting behind financials , which has a weighting of 32%. Financials fell 1.7% on Thursday as signs of weakness in U.S. regional banks spooked investors, while energy was down 1.9%. The price of oil settled 1.4% lower at $57.46 a barrel, its lowest level in five months. The real estate sector (.GSPTTRE) , opens new tab also lost ground, falling 0.7%, after mixed domestic housing data for September. Canadian home sales fell 1.7% last month from August, ending a string of increases that began in April, while housing starts rose 14%. The materials group added to its recent gains, rising 1.9%, as the price of gold climbed to another record high. Shares of Agnico Eagle Mines Ltd (AEM.TO) , opens new tab were up 3.8% and Barrick Mining Corp (ABX.TO) , opens new tab added 2.8%. https://www.reuters.com/business/tsx-futures-rise-commodity-strength-ahead-macklem-comments-2025-10-16/

2025-10-16 21:02

Ueda says no big gap between current, past views on global outlook Global growth resilient but tariff impact expected, Ueda says BOJ to keep raising rates if growth, prices move as projected Ueda drops few hints on whether BOJ could hike rates in October WASHINGTON, Oct 16 (Reuters) - Bank of Japan Governor Kazuo Ueda said on Thursday the central bank will scrutinise various data, including information he collects during his stay in Washington, in deciding whether to raise interest rates in October. He repeated his view that the central bank will hike rates if the likelihood of its growth and price forecasts materializing increases. Sign up here. Global and U.S. economies are showing resilience, though the impact of U.S. tariffs will likely emerge ahead, Ueda told a news conference after attending the G7 and G20 finance leaders' gatherings in Washington. "There's not much of a gap in how I see global and U.S. economies now and how I saw it back in Japan," he said. The International Monetary Fund edged up its 2025 global growth forecast on Tuesday as tariff shocks have proven more benign than expected, but warned that a renewed escalation in U.S.-China trade tensions could slow output significantly. In a speech earlier this month, Ueda said the global and U.S. economic outlook, as well as the fallout from U.S. tariffs on Japan's economy, will be key factors the BOJ will look at in deciding how soon to raise interest rates. "There's still some meetings left in Washington," said Ueda, who is scheduled to attend Friday's meeting of the IMF's steering committee. "I would like to keep gathering more information and scrutinise various data that comes out leading up to our October policy meeting," he said, when asked about the chance of a rate hike at the upcoming October 29-30 policy meeting. The BOJ ended a massive, decade-long stimulus programme last year and raised rates to 0.5% in January, on the view that Japan was on the cusp of durably hitting its inflation target. With inflation exceeding its 2% target for well over three years, the central bank has signaled its readiness to keep raising rates if the economy continues to improve. Highlighting the BOJ's growing attention to inflationary pressure, two of its nine board members proposed unsuccessfully to raise rates in September, which heightened market bets of a rate hike in October. But such expectations faded after the victory of Sanae Takaichi, an advocate of expansionary fiscal and monetary policy, in a ruling party leadership race that paved the way for her to become Japan's first female prime minister. Most analysts expect the BOJ to raise rates to 0.75% by January next year, though they are split on the exact timing. https://www.reuters.com/world/asia-pacific/bank-japan-chief-signals-need-more-data-deciding-october-move-2025-10-16/

2025-10-16 20:52

BOGOTA, Oct 16 (Reuters) - Colombia received a bid from a subsidiary of Denmark's Copenhagen Infrastructure Partners (CIP), to develop a project in the South American country's first offshore wind energy round, the head of its hydrocarbons agency said on Thursday. Orlando Velandia, who heads Colombia's National Hydrocarbons Agency (ANH), said CIP subsidiary CI GMF Cooperatief U.A. had submitted an offer. ANH not immediately provide details of the offer. Sign up here. "The participation of CIP, one of the world's leading investment funds in energy infrastructure and the green transition, represents an international vote of confidence," Velandia told a forum in Cartagena. The government aims to award contracts for at least 1 gigawatt of installed capacity in the bidding round. The country's Ministry of Mines and Energy in December gave preliminary approval to eight companies to participate. These also included Colombian companies Ecopetrol and Celsia as well as Belgium's Jan De Nul and DEME (DEME.BR) , opens new tab, Britain's Dyna Energy, Powerchina and China Three Gorges (600905.SS) , opens new tab. By February, participants had proposed 69 areas for potential project developments. Leftist President Gustavo Petro is looking to promote the development of renewable energies to wean the country off its dependence on polluting fossil fuels. https://www.reuters.com/sustainability/climate-energy/colombia-gets-offshore-wind-bid-denmarks-cip-2025-10-16/

2025-10-16 20:48

WASHINGTON, Oct 16 (Reuters) - U.S. Senate Democrats on Thursday blocked a bill that would have funded the Pentagon for a full year, thwarting an effort by Republicans to restart some federal funding as the government shutdown stretched into its 16th day. The tally was 50-44, falling short of the 60 needed to advance the measure in the 100-member Senate. The vote was largely along party lines, with President Donald Trump's fellow Republicans voting in favor and all but three Democrats objecting. Sign up here. Democrats who voted against advancing the legislation said they did not want to back spending on the military without providing funding for other programs, such as healthcare and housing, that are important to Americans. "It’s always been unacceptable to Democrats to do the defense bill without other bills that have so many things that are important to the American people in terms of healthcare, in terms of housing, in terms of safety," Senator Chuck Schumer of New York, the chamber's Democratic leader, told reporters before the vote. Republicans accused Democrats of playing politics by voting against the bill in order to keep their "leverage" in the debate over how to fund the government and end the shutdown that began on Oct. 1. "This is politics," Senate Majority Leader John Thune, of South Dakota, said, accusing Democrats of not being interested in supporting U.S. troops. Republicans control the House, Senate, and White House, but would need Democratic votes in the Senate to advance any bill to reopen the government because they control just 53 seats, not the 60 needed to advance most legislation. The $852 billion Defense Department appropriations bill was passed out of committee earlier this year with a strongly bipartisan 26-3 vote. Democrats say any funding package to reopen the government must also extend healthcare subsidies for about 24 million Americans that are due to expire at the end of the year. Trump signed an order on Wednesday directing Pentagon chief Pete Hegseth to ensure active-duty U.S. military personnel received pay this week despite the shutdown. https://www.reuters.com/world/us/military-spending-bill-blocked-us-senate-shutdown-grinds-2025-10-16/

2025-10-16 20:35

FERC grants similar extensions to other developers Plaquemines LNG aims for full service by mid-2027 Venture Global cites COVID challenges for extension request HOUSTON, Oct 16 (Reuters) - Federal regulators on Thursday approved a request from Venture Global (VG.N) , opens new tab for more time to keep its Plaquemines LNG plant in Louisiana in a commissioning stage before declaring the start of full commercial operations, a regulatory filing showed. Extending the commissioning phase allows Venture Global to sell the liquefied natural gas on the spot market at higher prices than under long-term contracts that apply during full operations. Sign up here. The Federal Energy Regulatory Commission said that while two of Venture Global's long-term customers for the facility - Chevron (CVX.N) , opens new tab and Orlen (PKN.WA) , opens new tab - asked to provide input, neither raised an objection to the extension request. An arbitration tribunal found last week that Venture Global breached an agreement with BP (BP.L) , opens new tab to declare timely commercial operations at its separate Calcasieu Pass plant in Louisiana. The LNG producer's shares have declined 36% over the past month amid the ruling and lower realized liquefaction fees in the second quarter. "As we stated previously, this in-service extension request is a standard procedural step," Venture Global said on Thursday, adding that it was unrelated to its planned timing for commercial deliveries. FERC has previously granted similar requests from other project developers. Venture Global asked FERC last month to give it until December 31, 2027 to keep the Plaquemines plant in a commissioning, citing issues including challenges that first originated during the COVID pandemic. The original deadline for putting the 27.2 million metric tons per annum export facility into full service was September 30, 2026. Plaquemines LNG has been planning to place all its Phase 1 facilities in service during the fourth quarter of 2026, and the remaining Phase 2 facilities in-service by mid-2027. Plaquemines is the second largest LNG facility in the U.S. and last month was responsible for nearly 16% of total exports of the superchilled gas from the country. Venture Global has typically used a strategy that involves building its plants quickly to sell commissioning cargoes at higher prices on the spot market for a time before formal commercial operations kick off with lower, longer-term pricing. https://www.reuters.com/business/energy/federal-regulators-approve-venture-global-commissioning-extension-plaquemines-2025-10-16/