2023-11-28 22:09

Nov 28 (Reuters) - Late payments on U.S. commercial property loans rose in November, driven by growing distress among office properties, according to a new report by Kroll Bond Rating Agency. The delinquency rate on U.S. commercial mortgage-backed securities (CMBS) reached 4.4% in November, climbing 19 basis points (bps) from October's 4.21%, according to a Tuesday report by KBRA. The trend is a reminder of the continued challenges facing property owners, which have struggled to keep up with interest payments and refinance their loans in an elevated rate environment. While loan distress on other property types such as retail and lodging have declined, those backed by offices climbed 116 bps to 8.84% in November. In its analysis of over $315 billion in CMBS, KBRA recorded 26 office loans this month that either became delinquent or faced default. Analysts and market participants have attributed much of offices' woes to the persistent post-pandemic remote working trend, which has led companies to avoid renewing their leases. Among the largest office loans in November facing default was RXR Realty's $670 million loan on the Helmsley Building, a skyscraper located at 230 Park Avenue in New York City. Office distress has accounted for roughly three-quarters, or $1.6 billion, of $2.1 billion in total newly distressed CMBS loans this month. Meanwhile, loan distress among retail and lodging properties declined for the sixth and fourth straight month respectively. https://www.reuters.com/markets/us/us-commercial-mortgage-distress-rises-november-office-woes-kbra-2023-11-28/

2023-11-28 22:01

https://www.reuters.com/markets/us/rate-cut-hopes-buoy-us-stocks-ahead-uncertain-2024-2023-11-29-2/

2023-11-28 21:51

Nov 29 (Reuters) - A look at the day ahead in Asian markets. Interest rate decisions and guidance from New Zealand and Thailand, and inflation figures from Australia will be the main events for Asian markets on Wednesday, as a curiously directionless week for risk assets reaches the midway point. While emerging market and Asian equities clocked up decent gains on Tuesday, Wall Street struggled to make much headway despite a seemingly constructive market and economic backdrop. The dollar, Treasury yields, and stock market volatility all fell, and U.S. consumer confidence was higher than expected. Fed Governor Christopher Waller - thought to be close to Fed Chair Jerome Powell's thinking on policy - also signaled that U.S. interest rates could be cut in the months ahead. The dollar and two-year Treasury yield slid to fresh three-month lows, the 10-year yield hit a two-month low and the VIX volatility index fell back to recent lows last seen before the pandemic. Yet the S&P 500 and Nasdaq ended flat. Perhaps that broad loosening of financial conditions will give Asian markets a bigger boost on Wednesday, although the underperformance of Chinese stocks shows little sign of abating even as the central bank chief pledged to keep monetary policy "accommodative" to provide support to the economy." The first of the main policy events in the region on Wednesday will be the Reserve Bank of New Zealand's policy decision. It is widely expected to hold the cash rate at 5.50%, so investors' interest will lie more in the bank's guidance. Traders expect up to 50 basis points of easing next year, with the first cut coming in July. That's about half of what the Fed is expected to do, so it's no wonder the New Zealand dollar is outperforming - it is up 6.5% in the past month. Thailand's central bank is also expected to keep rates on hold, at 2.50%, through the middle of 2025. Disappointing third quarter growth and the exchange rate's 7% appreciation over the last month will have eased any lingering pressure on policymakers to raise rates again. Finally, figures from Australia are expected to show that price pressures cooled in October, with the annual rate of weighted consumer inflation slowing to 5.20% from 5.60%. Reserve Bank of Australia Governor Michele Bullock on Tuesday reaffirmed that monetary policy was restrictive and working to dampen demand, though inflation in the service sector was proving sticker than hoped. The RBA is expected to keep its cash rate on hold at 4.35% next week, although there is around a 10% chance of a quarter point hike, according to futures market pricing. Here are key developments that could provide more direction to markets on Wednesday: - New Zealand interest rate decision - Thailand interest rate decision - Australia inflation https://www.reuters.com/markets/asia/global-markets-view-asia-pix-2023-11-28/

2023-11-28 21:17

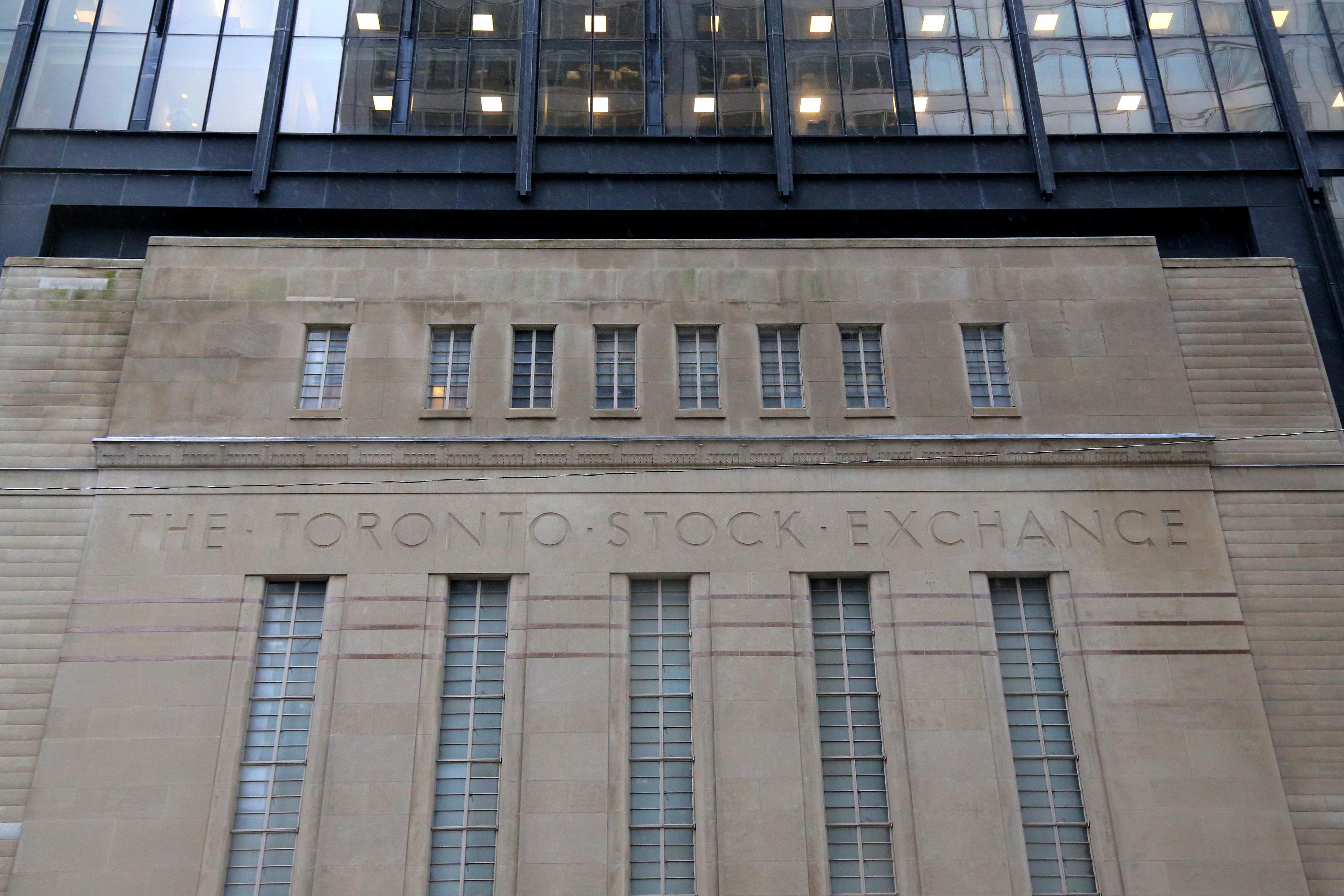

TSX ends up 4.11 points at 20,036.77 Energy rallies 0.8%; oil settles 2.1% higher Bank of Nova Scotia slides on Q4 profit miss First Quantum falls on Panama court ruling Nov 28 (Reuters) - Canada's commodity-linked main stock index ended higher on Tuesday, recouping its earlier decline, as gains for energy and gold mining shares offset weakness in financials following Bank of Nova Scotia's profit miss. The Toronto Stock Exchange's S&P/TSX composite index (.GSPTSE) ended up 4.11 points at 20,036.77, after earlier hitting its lowest intraday level in two weeks. The energy sector rallied 0.8% as the price of oil settled 2.1% higher at $76.41 a barrel on the possibility OPEC+ will extend or deepen supply cuts. The materials group, which includes precious and base metals miners and fertilizer companies, added 2.5% as gold climbed to a more than six-month high, driven by a retreating U.S. dollar and expectations that the U.S. Federal Reserve has finished hiking interest rates. Bank of Nova Scotia (BNS.TO) shares fell 4.4% after the lender missed fourth-quarter profit estimates, while the financials sector (.SPTTFS) lost 0.8%. Shares of First Quantum Minerals Ltd (FM.TO) shed 0.8% after Panama's Supreme Court ruled the miner's contract to operate a lucrative copper mine in the Central American nation is unconstitutional. The TSX is on track for a monthly advance of 6.2%, which would be its biggest since January, as hopes grow that global interest rates have peaked. Canada's third-quarter gross domestic product (GDP) report and November employment numbers later this week could offer clues on the Bank of Canada's interest rate outlook. https://www.reuters.com/markets/tsx-futures-fall-ahead-more-economic-data-bank-earnings-focus-2023-11-28/

2023-11-28 21:10

Nov 28 (Reuters) - Canada's main oil-producing province Alberta on Tuesday said it would provide a 12% grant on eligible capital costs associated with building new carbon capture utilization and storage (CCUS) projects to help industry cut emissions that cause climate change. The incentive from Alberta, which the provincial government has been working on since January, comes on top of a federal government CCUS tax credit announced last year and is designed to spur investment in the costly technology. Canada, the world's fourth-largest oil producer, is aiming to cut carbon emissions 40-45% below 2005 levels by 2030 but will struggle to hit that target without significant reductions from Alberta, the country's oil and gas heartland and highest-polluting province. Alberta Energy Minister Brian Jean said CCUS is the "only viable option" to cut emissions of hard-to-abate industries, such as oil and gas, cement and petrochemicals. "Not only will this technology help preserve our position as a major bitumen producer, but our whole economy will depend on CCUS for large volumes of reduced emissions reductions," Jean told a news conference. Alberta Premier Danielle Smith said the incentive program was expected to help attract C$35 billion ($25.80 billion) in capital investment and cost the province between C$3.5 billion and C$5.3 billion. Chemical maker Dow (DOW.N) said federal and provincial government CCUS incentives contributed to its board's decision on Tuesday to approve a C$6.5 billion investment in its existing Fort Saskatchewan, Alberta, facility. The Path2Zero project includes building a new ethylene cracker and increasing polyethylene capacity by 2 million metric tonnes per annum, and will use CCUS to help meet net-zero emissions. More than twenty new CCUS projects have been proposed in Alberta, including a C$16.5 billion project put forward by the Pathways Alliance, a consortium of Canada's six biggest oil sands producers. Pathways has long said its project, expected to reach a final investment decision in 2025, needs significant government support to move forward and welcomed Alberta's move. "This announcement is another step that will move us closer to the regulatory certainty and capital investment commitments necessary for our sector to remain cost competitive with other oil-producing regions around the world while reducing emissions," Pathways president Kendall Dilling said in a statement. Many environmental campaigners argue CCUS is an expensive and inefficient way to cut emissions, however, and risks prolonging the life of fossil fuel projects when the world should be focusing on renewable energy. A report released on Tuesday from clean energy think-tank the Pembina Institute said Canadian oil sands crude ranks among the highest-cost and most carbon-intensive in the world, and could become uncompetitive as global oil demand falls. Pembina said governments should take care not to "over-incentivise" CCUS projects, given the risk of some oil sands projects becoming stranded assets as the world transitions to cleaner energy. ($1 = 1.3567 Canadian dollars) https://www.reuters.com/markets/carbon/alberta-government-announces-carbon-capture-storage-incentive-program-2023-11-28/

2023-11-28 20:49

Nov 28 (Reuters) - The labels “dove” and “hawk” have long been used by central bank watchers to describe the monetary policy leanings of policymakers, with a dove more focused on risks to the labor market and a hawk more focused on the threat of inflation. The topsy-turvy economic environment of the coronavirus pandemic sidelined those differences, turning U.S. Federal Reserve officials at first universally dovish as they sought to provide massive accommodation to a cratering economy, and then, when inflation surged, into hawks who uniformly backed aggressive rate hikes. Now, as Fed policymakers note improvement on inflation and some cooling in the labor market but also stronger-than-expected economic growth, divisions are more evident, and the choices more varied: to raise rates again, skip for now but stay poised for more later, or take an extended pause. All 12 regional Fed presidents discuss and debate monetary policy at Federal Open Market Committee (FOMC) meetings, held eight times a year, but only five cast votes at any given meeting, including the New York Fed president and four others who vote for one year at a time on a rotating schedule. The following chart offers a stab at how officials currently stack up on their outlook for Fed policy and how to balance their goals of stable prices and full employment. The designations are based on comments and published remarks; for more on the thinking that shaped these hawk-dove designations, click on the photos in the graphic. Over time Reuters has shifted policymaker designations based on fresh comments and developing circumstances - for an accounting of how our counts have changed please scroll to the bottom of this story. Note: Fed policymakers began raising interest rates in March 2022 to bring down high inflation. Their most recent policy rate hike, to a range of 5.25%-5.5%, was in July. Most policymakers as of September expected one more rate hike by year’s end, but recently many have expressed more confidence that none will be needed. Neither Jeff Schmid, Kansas City Fed's president since August and a voter in 2025, nor Adriana Kugler, a permanent voter who was confirmed to the Fed Board in September, have yet made any substantive policy remarks. The St. Louis Fed has begun a search to succeed its president, James Bullard, who took a job in academia; the new chief will be a 2025 voter. Below is a Reuters' count of policymakers in each category, heading into recent Fed meetings. https://www.reuters.com/markets/us/fed-hawks-fed-doves-what-us-central-bankers-are-saying-2023-11-28/