2024-07-01 08:06

July 1 (Reuters) - Shares in Anglo American (AAL.L) New Tab, opens new tab slid 3% on Monday after the miner suspended production at its Grosvenor steelmaking coal mine in Australia following an underground fire that broke out over the weekend. Anglo American said on Sunday it was battling an underground fire at the mine in Australia's Queensland state after a blaze ignited there on Saturday. "We believe this incident could have negative implications for the timing and execution of Anglo's corporate restructuring plan and therefore future potential corporate outcomes for Anglo," JP Morgan analysts wrote in a note. Other analysts said the suspension could delay the sale of Anglo's coal assets and hit its valuation as the Australian metallurgical coal assets were the ones the market was expecting management to be able to divest most quickly. According to analysts at Jefferies, Grosvenor accounts for about 30% of the $4.5 billion value the brokerage attributes to Anglo's steelmaking coal business. The London-listed miner had in May outlined a plan to divest less profitable assets and focus on expanding copper output after BHP's failed attempt to takeover the company. Anglo shares underperformed the wider FTSE 100 index in early Monday trade. They were the biggest percentage losers on the London bluechip index. Sign up here. https://www.reuters.com/markets/commodities/anglo-american-shares-fall-after-australian-mine-suspension-2024-07-01/

2024-07-01 08:04

NAPERVILLE, Illinois, June 30 (Reuters) - Speculators deepened their short bets in Chicago traded corn ahead of last week’s major U.S. data release, establishing their most bearish-ever corn views for the end of June. In the week ended June 25, money managers boosted their net short in CBOT corn futures and options to 277,666 contracts, an increase of more than 86,000 on the week. That marked funds’ biggest weekly net selling in corn since May 2023 and was the result of both new shorts and exiting longs. December corn futures shed more than 5% in the four-session week ended June 25, which was the year’s biggest four-session slide until Friday. Modest U.S. demand and favorable weather forecasts encouraged the negative sentiment. Money managers had held a very similar corn position on the same date in 2020, but they quickly covered shorts as the U.S. Department of Agriculture’s June survey showed drastically fewer planted corn acres than anticipated for the 2020 harvest. Friday featured the opposite scenario, as USDA estimated 2024 U.S. corn plantings at 91.475 million acres, above the range of trade guesses and 1.6% higher than in the March survey. This is the fourth time in six years that USDA’s June corn area fell outside the analyst range. Funds’ corn selloff in the days before the report paid off as December corn fell another 5% in the last three sessions, stamping a new yearly low of $4.12 per bushel on Friday. U.S. soybean plantings came in below the average trade guess for a 10th consecutive year, though the 86.1 million acres were within the expectation range. November soybeans surged briefly on Friday’s data, but inked a new yearly low of $11.00 per bushel just before the close. November beans lost 0.7% between Wednesday and Friday, following a 1.8% decline in the week ended June 25. Money managers that week continued their steepest selloff in CBOT soybean futures and options since December 2019, extending their net short to an eight-week high of 129,663 contracts from 105,970 a week prior. New gross shorts accounted for most of the move. That also sets up funds’ most bearish end-of-June position in soybeans, topping 2017’s high of nearly 119,000 contracts. CBOT September wheat plunged more than 6% in the week ended June 25, bringing four-week losses to 22%. That put futures close to the contract low of $5.50 per bushel, though wheat popped more than 2% in the last three sessions with strength on Thursday. In the week ended June 25, money managers lifted their net short in CBOT wheat futures and options to a nine-week high of 70,487 contracts from 52,732 in the prior week. That included more than 21,000 new gross shorts, the most for any week since December 2017. The new wheat stance is funds’ second most bearish for the date after 2016, and the net short is larger than the year-ago position for the first time in three months. U.S. markets will be closed on Thursday, though traders will continue to monitor weather forecasts for U.S. corn and soybeans, which enter sensitive development periods in July. As of Sunday, the short-term weather outlook appeared largely non-threatening to crops. Karen Braun is a market analyst for Reuters. Views expressed above are her own. Sign up here. https://www.reuters.com/markets/us/funds-heavily-sold-cbot-corn-ahead-bearish-us-acreage-data-2024-07-01/

2024-07-01 08:03

BEIJING, July 1 (Reuters) - A Chinese radio station on Monday started broadcasts on Arctic sea ice conditions off Russia's coast for vessels sailing the Northeast Passage, as China seeks to further utilise the world's northernmost routes as alternatives to the Suez Canal. Arctic sea routes are increasingly being used as an alternative global trade route connecting the Pacific Ocean and Atlantic Ocean to major economies as global warming shrinks ice packs and also allows for longer ice-free periods for vessels. China and Russia have also been working together to develop Arctic shipping routes as Russia seeks to deliver more oil and gas to China amid Western sanctions while China seeks an alternative shipping route to reduce its dependence on the Strait of Malacca. The Tianjin Coastal Station, run by the northern Chinese port city of Tianjin, has begun broadcasting sea ice analyses and forecasts and weather information for the Bering Strait, Dmitry Laptev Strait, Velikitsky Strait and Kara Strait along the Russian coast, Tianjin Daily reported on Monday. From July 1 to Oct. 31, the radio station will run Arctic bulletins every day at 2 p.m. and 10 p.m. Beijing time, the state-run newspaper said. The Northeast Passage, also known as the Northern Sea Route (NSR), in particular shortens the distances between Europe and East Asia compared to the traditional route via the Suez Canal. The NSR runs from Murmansk near Russia's border with Norway to the Bering Strait near Alaska, spanning 13,000 km (8,078 miles). In contrast, shipping routes between Europe and Asia via the Suez Canal are about 21,000 kilometres. China currently imports some of its liquefied natural gas from Russia via the Arctic, mainly through a Yamal project operated by Russian energy company Novatek (NVTK.MM) New Tab, opens new tab, in which China National Petroleum Corp and China's state-run Silk Road Fund each has a stake. The Yamal LNG project delivers to the Northeast Asian market through the NSR during summer, while in winter, it delivers via westward routes. Russian energy giant Gazprom (GAZP.MM) New Tab, opens new tab delivered its first cargo of LNG via the NSR to China in September last year. India, the biggest buyer of seaborne Russia oil, has also expressed interest in working with Moscow on Arctic shipping and related economic cooperation. Sign up here. https://www.reuters.com/markets/asia/china-starts-regular-sea-ice-forecasts-northeast-passage-off-russian-coast-2024-07-01/

2024-07-01 07:56

JOHANNESBURG, July 1 (Reuters) - South Africa's rand strengthened in early trade on Monday after President Cyril Ramaphosa announced his new coalition cabinet, appointing the leader of the former opposition Democratic Alliance (DA) as agriculture minister. At 0737 GMT, the rand traded at 18.0150 against the dollar , 1% stronger than its previous close. After weeks of intense deliberations, Ramaphosa named DA leader John Steenhuisen as part of his cabinet line-up on Sunday, bringing the party and other coalition members into his new government team. "There will be a palpable sense of relief that Mr Ramaphosa has finally named his executive following protracted and often terse negotiations with his new coalition partners," Oxford Economics said in a research note. Ramaphosa's African National Congress (ANC) lost its majority for the first time in three decades in a May 29 election and has formed a unity government with former rivals as a way to stay in power. The new 32-member cabinet includes ministers from seven different parties. Domestic investor focus will be on a monthly purchasing managers' index (PMI) survey for the local manufacturing sector by Absa and vehicle sales figures, both due to be released later on Monday. On the stock market, the Top-40 (.JTOPI) New Tab, opens new tab index was up 0.5% while the broader all-share (.JALSH) New Tab, opens new tab traded 0.8% higher in early trade. South Africa's benchmark 2030 government bond was stronger, with the yield down 14.5 basis points to 9.840%. Sign up here. https://www.reuters.com/markets/south-african-rand-gains-after-ramaphosa-announces-new-cabinet-2024-07-01/

2024-07-01 07:56

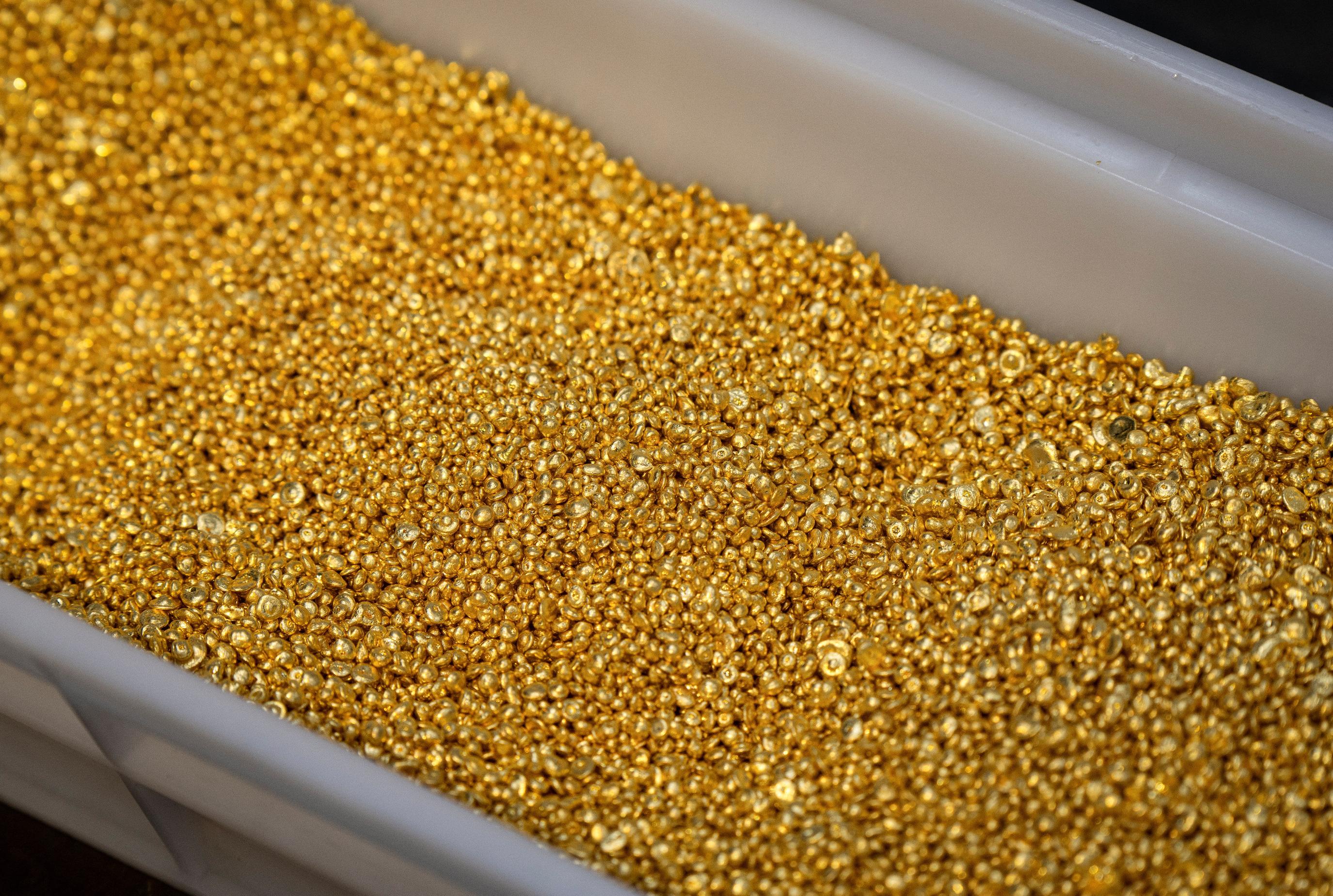

Fed Chair Powell to speak on Tuesday Fed minutes of June policy meeting on Wednesday Non-farm payrolls data due on Friday July 1 (Reuters) - Gold prices rose on Monday as the dollar softened, while investors turned cautious ahead of key economic data that could shed light on the Federal Reserve's potential rate cut trajectory. Spot gold rose 0.4% to $2,335.40 per ounce, as of 1128 GMT. Prices registered a more than 4% gain in the second quarter. U.S. gold futures gained 0.3% to $2,345.70. The dollar fell 0.2% against its rivals, making gold attractive for holders of other currencies. Investor focus now shifts to remarks from Fed Chair Jerome Powell on Tuesday, followed by minutes from the Fed's latest policy meeting on Wednesday and U.S. nonfarm payrolls data due on Friday. "Powell is likely to stick to a data-dependent stance, so should payrolls later this week come in softer, it could again lift gold prices," UBS analyst Giovanni Staunovo said, adding that gold will soar to $2,600 by the end of the year, boosted by Fed rate cuts. Data last week showed that the U.S. prices were unchanged in May, while consumer spending rose moderately. Market now sees a 64% chance of the Fed cutting interest rates in September as well as another cut in December. "The upside is capped today probably also by the outcome of the French elections, supporting the euro and the French equity market," UBS' Staunovo said. The euro jumped after a convincing and historic win by the French far right in the first round of parliamentary elections. "Gold's bounce off the $2,300 an ounce mark last week was a bullish signal in itself ... This suggests buyers are willing to step into the market at levels below $2,300," Kinesis Money said in a note. Spot silver was up 0.6% at $29.29, platinum fell 1.2% to $981.79 and palladium gained 1.3% to $985.20. Sign up here. https://www.reuters.com/markets/commodities/gold-holds-ground-slowing-inflation-boosts-fed-rate-cut-bets-2024-07-01/

2024-07-01 07:04

HOUSTON, July 1 (Reuters) - About 20 ships loaded crude oil on Canada's West Coast in the first full month of operation on the newly expanded Trans Mountain pipeline, according to vessel-tracking data on Sunday, slightly below the operator's forecast. Loadings from the pipeline expansion are closely watched because the Canadian government wants to sell the $24.84 billion (C$34 billion) line. Questions about oil quality, pipeline economics and loading challenges have swirled since its startup, spurring concerns over demand and exports of the crude. The 20 vessels loaded were less than the 22 ships that Trans Mountain had initially expected to load for the month. Total crude exports from Vancouver were around 350,000 barrels per day with the last two vessels for June-loading at the Westridge Marine terminal, as of Sunday. "This first month is just shy of the 350,000-400,000 bpd we expected ahead of the startup. We are still in the discovery phase, with kinks being ironed out ... but in the grand scheme of things, this has been a solid start," said Matt Smith, lead analyst at Kpler. The vessels, partially loaded Aframaxes able to carry about 550,000 barrels each, mostly sailed to the U.S. West Coast and Asia. Some cargoes were loaded onto larger ships for delivery to India and China, according to data providers LSEG, Kpler and Vortexa. Reliance Industries (RELI.NS) New Tab, opens new tab bought 2 million barrels of Canadian crude for July delivery, a deal that involved four ship-to-ship transfers to load the oil onto a very large crude carrier offshore California. The oil is destined for Sikka, India, where the company operates the world's biggest refining complex. Phillips 66 (PSX.N) New Tab, opens new tab acquired a cargo for its Ferndale, Washington, refinery, Marathon Petroleum Corp (MPC.N) New Tab, opens new tab for its Los Angeles refinery, and Valero Energy Corp (VLO.N) New Tab, opens new tab for its Benicia, California, refinery. TMX did not immediately respond ahead of a long weekend in Canada. Phillips 66 and Marathon Petroleum declined to comment, while Valero did not reply to a request for comments. The market was expecting about 17 to 18 loadings, said Rohit Rathod, market analyst at energy researcher Vortexa. "Chinese demand has been below expectations, and if not for Reliance most of the barrels in June would have remained within the (West Coast) region," Rathod added. Trans Mountain this month revised standards for accepting crude oil on its recently expanded system, alleviating worries about the acidity and vapor pressure of the line's crude oil. Logistical constraints in a busy, narrow shipping channel after leaving the Westridge dock in Vancouver were also expected to impact loadings. To manage high traffic in the channel, the Port of Vancouver has restrictions on transit times. The expanded Trans Mountain pipeline is running around 80% full with some spot capacity used. Trans Mountain forecasts 96% utilization from next year. It has capacity to load 34 Aframax ships a month. Sign up here. https://www.reuters.com/business/energy/trans-mountain-oil-pipeline-just-shy-target-first-month-loadings-2024-07-01/