2024-03-28 13:52

Canada's January GDP at 0.6% against 0.4% forecast February GDP likely to have grown by 0.4% Broad-based growth led by end of strike in Quebec OTTAWA, March 28 (Reuters) - Canada's gross domestic product strongly rebounded in January exceeding expectations and February's preliminary estimates point to another expansion, data showed on Thursday, tempering pressure on the Bank of Canada (BoC) for an early rate cut. The economy grew by 0.6% in January, its fastest growth rate in a year, which the Statistics Canada called a broad-based expansion led by a bounce back in education services benefiting from an end of public sector strikes in Quebec. February's GDP is also likely to have grown by 0.4% with main contributions from mining, quarrying and oil and gas extraction, though other industries will also likely contribute, it said. Analysts polled by Reuters had forecast a GDP growth of 0.4% on a month-on-month basis in January. December GDP was revised to a 0.1% contraction from zero growth initially reported. Money markets slightly trimmed their bets for a first 25 basis point rate cut in June to 69% from just over 70% before the GDP numbers were released. They widely expect the BoC to hold its key overnight rate at the same level on April 10 and a rate cut in July is fully priced in. The Canadian dollar pared losses after the numbers, with the loonie trading 0.01% stronger to 1.3579 against the greenback at 1340 GMT. The two-year government bond yields also rose by 4.6 basis points to 4.188%. The strong start to the year and the forecast for February show that the GDP is likely to close the first quarter better than the BoC 0.5% growth projection. The data "clearly suggests there is no urgency for an immediate reduction in interest rates," Andrew Grantham, senior economist at CIBC, wrote in a note. The central bank has maintained its key policy rate at a 22-year high of 5% since July, but BoC's Governing Council in March agreed that conditions for rate cuts should materialize this year if the economy evolves in line with its projections. Canada's economy has evaded recession in the face of high interest rates which the BoC has maintained at a 22-year high of 5% for the last eight months in efforts to rein in inflation. But high borrowing costs have nibbled at consumer spending and business investments, keeping growth largely muted. Its growth stalled in the second half of last year and GDP was flat or negative on a monthly basis in four out of the last six months of 2023. The BoC will release new projections along with its rate announcement on April 10. "The surprisingly healthy start to 2024 points to above-potential growth in Q1, which could make the BoC a bit less comfortable with the inflation outlook," said Doug Porter, chief economist at BMO Capital Markets in a note, adding that a June rate cut projection will depend on the next inflation report. Canada's inflation rate surprisingly cooled to 2.8% in February, its slowest pace since June. Growth in January was broad-based, with 18 out of 20 sectors expanding output in the month, Statscan said. Real estate and rental and leasing grew for the third consecutive month, as activity at the offices of real estate agents and brokers drove the gain in January, it said. Overall, the services-producing industries grew 0.7%, while the goods-producing expanded 0.2%. Following three consecutive monthly increases, the mining, quarrying and oil and gas extraction sector declined 1.9% in January, as two of three subsectors contracted. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/canadas-gdp-outperforms-jan-growth-forecast-likely-grew-04-feb-2024-03-28/

2024-03-28 13:06

WARSAW, March 28 (Reuters) - The Polish and Ukrainian governments meet in Warsaw on Thursday for talks to defuse a row over grain imports that has caused mass protests by farmers, but a top Polish official said a breakthrough was unlikely. Farmers in Poland and elsewhere in the European Union have been protesting to demand the re-imposition of customs duties on agricultural imports from Ukraine that were waived after Russia's invasion in 2022. They say Ukraine's farmers are flooding Europe with cheap imports that leave them unable to compete. "It is difficult to expect any breakthrough after these talks, any specific agreement, for example on agricultural issues," Jan Grabiec, head of the prime minister's office, told state news agency PAP. "We are still in dialogue and both sides - at least for today - are not fully satisfied." Poland has been eyeing a licensing deal for agricultural trade with Ukraine similar to one agreed with Kyiv by Romania and Bulgaria. On Wednesday Polish Agriculture Minister Czeslaw Siekierski said talks were ongoing about a system of licensing exports, but that there were differences over the range of products that would be covered. Ukrainian Farm Minister Mykola Solsky said the discussions with Poland were "complicated but frank". "It is important that we have already discussed solutions that will soon be announced. At the same time, the issue is difficult for all parties and requires additional time," he said in a statement. Grabiec said almost the entire Ukrainian government would be represented at the talks, which Deputy Foreign Minister Andrzej Szejna told public radio would also cover cooperation between the countries' arms industries, cultural issues and energy. "We will discuss arms for Ukraine, the situation on our countries' borders, trade development and infrastructure. Count on a pragmatic and constructive dialogue and the development of effective solutions," Ukrainian Prime Minister Denys Shmyhal wrote on X ahead of the talks. Ambassadors from European Union countries reached a revised deal on Wednesday to extend tariff-free food imports from Ukraine - with restrictions - after some states, including Poland, complained the original agreement risked destabilising the bloc's agricultural markets. An EU diplomat said the new deal - which would run until June 2025 - was similar to a provisional agreement struck last week but changed the reference period used to determine when tariffs on some products would be applied. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/europe/poland-says-breakthrough-ukrainian-grain-unlikely-warsaw-talks-2024-03-28/

2024-03-28 12:44

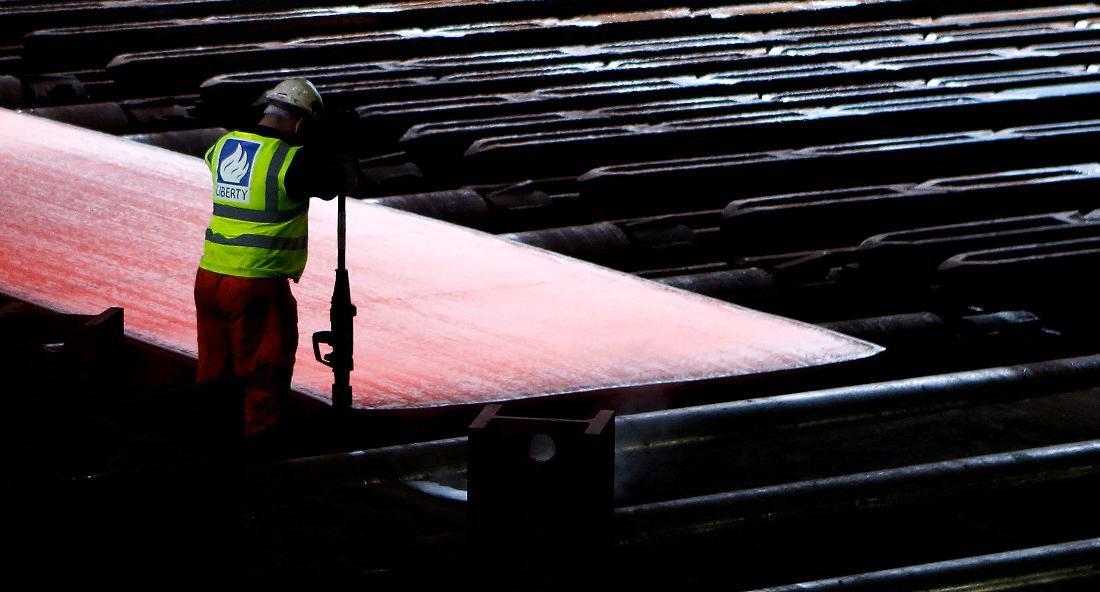

LONDON, March 28 (Reuters) - Liberty Steel, owned by commodities tycoon Sanjeev Gupta, has reached an agreement with major creditors after raising capital, paving the way for a restructuring of its British business, it said on Thursday. Liberty is part of Gupta's family conglomerate, GFG Alliance, which has been refinancing its businesses in steel, aluminium and energy after its backer, supply chain finance firm Greensill, filed for insolvency in March 2021. The capital increase includes a $350 million bond issue by one of its Australian units through Jefferies and a $350 million asset-backed term loan from BlackRock and Silver Point Finance, a statement said. The creditor agreement, which mainly involves debt of its British businesses, will allow Liberty to consolidate its British steel business under a new entity and corporate structure. As part of the plan, Liberty, which has nine sites in Britain, plans to double melting capacity at its Rotherham plant in northern England to 2 million metric tons a year. In January last year, Liberty suspended operations at two British plants and cut output at Rotherham due to high power prices. Liberty also has operations in Europe, Australia and the United States. Its Czech business Liberty Ostrava had said it would restart its blast furnace in January and increase production. In 2021, Britain's Serious Fraud Office opened an investigation into alleged fraud, fraudulent trading and money laundering at GFG Alliance. The company had consistently rejected any wrongdoing and pledged full cooperation. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/liberty-steel-restructure-uk-business-after-deal-with-creditors-2024-03-28/

2024-03-28 12:19

WARSAW, March 28 (Reuters) - Poland and Ukraine are closer to reaching an agreement regarding agricultural imports, the Polish prime minister said on Thurdsay after intergovernmental talks, as Warsaw seeks to defuse farmers' protests. "we are close to a solution," Donald Tusk told a news conference. "This applies to the amount of products that can flow into Poland, once we determine it, we are close to ensuring that transit does not disturb the Polish market." The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/europe/poland-ukraine-close-agreement-food-imports-says-tusk-2024-03-28/

2024-03-28 12:04

March 28 (Reuters) - EnCap Investments is seeking to sell XCL Resources, four people familiar with the matter said, two years after the private equity firm's plan to combine the oil and gas producer with a local rival was thwarted by U.S. antitrust regulators. XCL, one of the largest energy producers in the Uinta shale formation of Utah, could be worth at least $2.8 billion including debt, and could achieve a higher valuation when accounting for its undeveloped assets, the sources said. Investment bankers at Jefferies Financial Group (JEF.N) , opens new tab are running the sale process for XCL, which kicked off earlier this month, the sources added, requesting anonymity because the matter is confidential. An EnCap spokesperson declined comment, as did a Jefferies spokesperson. XCL and Rice Investment Group, which owns a minority position in XCL, did not respond to requests for comment. EnCap first invested in XCL in 2018 with a $400 million capital commitment. XCL has around 45,000 net acres in the Uinta, according to its website. The company produces around 55,000 barrels of oil equivalent per day, the sources said. XCL also owns assets used for transporting water using in energy production. A sand mine the company is developing to source the material used in the fracking process to break open rock will be online later this year. The type of oil extracted in the Uinta is unlike any other crude grade found in the United States, with a waxy consistency and a high paraffin content, according to Utah's Department of Environmental Quality. EnCap agreed in August 2021 to buy EP Energy, which had assets in the Uinta and South Texas, for $1.5 billion, with the aim of merging EP's Uinta assets with XCL. However, the Federal Trade Commission threatened to sue and block the deal over fears it would reduce competition and lead to higher prices for Utah consumers. Crescent Energy (CRGY.N) , opens new tab acquired EP's Uinta assets in 2022 instead. A new suitor for XCL may not face the same antitrust hurdles. The FTC said , opens new tab earlier this month the Uinta Basin's competitive landscape had "changed significantly" since the aborted EP deal, as more oil production and an increased number of operators reduced the risk of producers raising prices unilaterally. U.S. oil and gas producers went on a $192 billion buying spree in 2023, taking advantage of acquirers' high stock prices to secure lower-cost reserves. The FTC is now scrutinizing many of these deals. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/business/finance/encap-investments-seeks-sale-utah-oil-producer-xcl-resources-sources-say-2024-03-28/

2024-03-28 11:54

LONDON, March 28 (Reuters) - Britannia, the insurer of container ship the Dali, is working with the vessel's owner and U.S. authorities on the investigation into the collapse of Baltimore's Francis Scott Key Bridge, the insurer said on Thursday. The bridge collapsed on Tuesday after the Dali suffered a power outage and struck a pylon, causing huge disruption in the port. "We are working closely with the vessel’s owner and manager and the relevant U.S. authorities as part of the investigation into the casualty," Britannia said in a statement. The disaster is likely to result in industry-wide multi-billion-dollar insurance claims, which could make it the largest single marine insurance loss, Lloyd's of London (SOLYD.UL) chairperson Bruce Carnegie-Brown told Reuters earlier on Thursday. Ship liability insurance, which covers marine environmental damage and injury, is provided through protection and indemnity insurers such as Britannia, known as P&I Clubs. Britannia declined to comment further. The International Group of P&I Clubs collectively insures approximately 90% of the world's ocean-going tonnage and member P&I clubs mutually reinsure each other by sharing claims above $10 million. The group holds reinsurance cover up to the value of $3.1 billion. The P&I Clubs may be liable for issues such as the repair of the bridge and clearance of the wreckage, one industry source said. Reinsurers - who insure the insurers - in the London market and major European players such Swiss Re (SRENH.S) , opens new tab and Hannover Re (HNRGn.DE) , opens new tab are likely to also face claims, industry sources say. Swiss Re and Hannover Re declined to comment. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/ship-insurer-britannia-says-its-helping-baltimore-bridge-collapse-probe-2024-03-28/